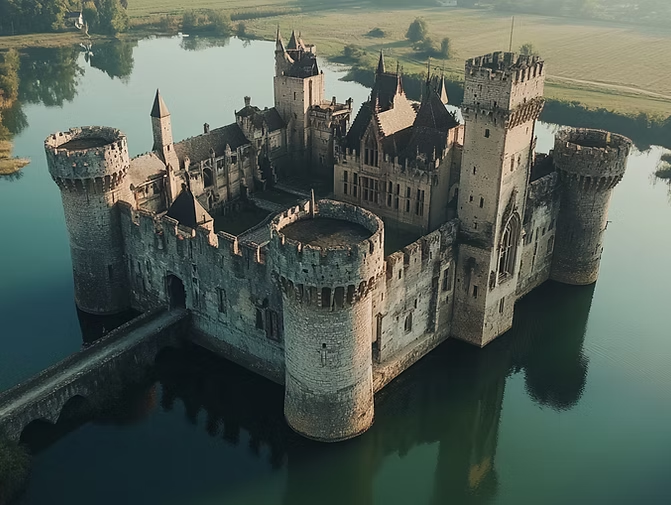

Building Your

Wealth Castle

The Entrepreneur's Guide to Bulletproof Asset Protection: When Everything You've Built Could Be Gone Tomorrow

Is your legacy protected from unexpected threats?

As a seven to nine-figure entrepreneur, you've spent years—perhaps decades—building your wealth. Late nights. Endless sacrifices. Countless risks. In a single moment, without proper protection, it could all vanish. A disgruntled employee files a lawsuit. A car accident results in a judgment exceeding your insurance limits. A business partnership dissolves with unexpected hostility. These aren't hypothetical scenarios—they're the reality for entrepreneurs who believed "it won't happen to me."

Consider the cautionary tale of Elizabeth Holmes, who once commanded a $9 billion valuation with Theranos, only to lose everything through legal battles. Or Adam Neumann of WeWork, whose personal fortune dramatically diminished after business setbacks exposed gaps in his wealth protection strategy.

Even the wealthy and seemingly invincible can fall. 50 Cent filed for bankruptcy despite his massive success, largely due to personal liability issues that proper asset protection could have mitigated. The question isn't whether threats to your wealth exist—it's whether you've built sufficient defenses to withstand them.

The Castle Approach to Asset Protection

Medieval castles weren't defended by a single wall. They employed multiple, integrated defense systems—moats, walls, drawbridges, and hidden vaults—each serving a specific purpose in protecting what was most valuable.

Your wealth deserves the same thoughtful, layered protection.

The most successful entrepreneurs understand that comprehensive asset protection isn't about a single strategy—it's about building a complete fortress around your wealth, with each layer reinforcing the others.

Your Wealth Castle:

Building a Fortress Around Your Assets

When entrepreneurs build significant wealth, they need a fortress to protect it. Throughout history, the most successful wealth preservers think about protection like building and defending a medieval castle. Each layer of protection serves a specific purpose, working together to create an impenetrable defense against modern threats like lawsuits, creditors, and financial risks.

Your wealth castle has four essential components, each providing a distinct layer of protection:

The Moat

Insurance as your first line of defense against unforeseen losses

The Castle Walls

Strategic legal protections through state laws & financial tools

The Drawbridge

Entity structures controlling access between business & personal wealth

The Hidden Vaults

Trust structures that create separation between you & your assets

The Moat: Insurance as Your First Line of Defense

Just as a castle's moat provides initial protection from invaders, comprehensive insurance creates your wealth's first barrier against claims. Many seven to nine-figure entrepreneurs maintain the same insurance coverage they had when their net worth was significantly lower. This creates a dangerous mismatch between risk exposure and protection.

For example, standard auto policies typically provide just $100,000-$300,000 in liability coverage. Consider what happens when a serious accident results in a $3 million judgment: without proper coverage, the remaining $2.7 million comes directly from your personal assets.

Consider the experience of tech entrepreneur Elon Musk, who faced significant personal exposure during Tesla's early struggles. Without proper liability protections in place, his personal fortune could have been jeopardized by business setbacks—an important reminder that even visionaries need proper insurance shields around their wealth castles.

Critical Insurance Policies Every Wealthy Entrepreneur Needs

Personal Protection

- High-limit Umbrella Insurance: Extends your liability coverage by $1-$10 million beyond your base policies, acting as a deeper, wider moat around your castle

- Enhanced Homeowner's Coverage: Not just for property damage, but for personal liability occurring on your property—fortifying your moat's perimeter

- Specialized Auto Insurance: With liability limits that match your net worth, not just state minimums

- Uninsured/Underinsured Motorist Coverage: Protection when others don't have adequate insurance—ensuring your moat remains effective even when attackers are unprepared

Business Protection

- Professional Liability/E&O Insurance: Protects against claims of negligence or inadequate work

- Employment Practices Liability: Covers claims from employees alleging discrimination, harassment, or wrongful termination

- Cyber Liability: Critical protection in our digital age, like specialized defenses for modern threats to your castle

The Castle Walls: Legal Protections & Financial Tools

Beyond the moat, a castle's walls provide substantial physical barriers against attack. Similarly, your wealth needs strong walls built from legal protections and strategic financial tools.

Strategic State-Based Protections

Just as castle builders chose strategic locations with natural defenses, smart entrepreneurs leverage state-specific protections to reinforce their wealth castle walls.

Not all states offer equal asset protection. Florida and Texas, for instance, provide unlimited homestead exemptions, protecting your primary residence regardless of value—like having castle walls of exceptional height and thickness. Other states offer minimal protection—equivalent to thin, easily breached walls.

Homestead Exemption Comparison

Florida: Unlimited value protection for up to 160 acres in rural areas—the strongest castle walls

Texas: Protection for up to 10 acres urban/100 acres rural—similarly robust walls

California: Limited to approximately $600,000 in protection—substantial but penetrable walls

New Jersey: Just $15,000 in protection—dangerously thin barriers

Retirement Accounts as Reinforced Sections of Your Castle Wall

Qualified retirement accounts serve as specially reinforced sections of your castle wall:

- 401(k) Plans: Nearly impossible for creditors to access under ERISA—like the most impenetrable section of your wall

- Traditional IRAs: Up to $1.5 million federally protected in bankruptcy—a substantial barrier

- Roth IRAs: Similar protections to Traditional IRAs

- Inherited IRAs: Often lack protection without proper planning—potential weak points in your wall

Financial Tools as Strategic Wall Reinforcements

Beyond their financial benefits, certain insurance products create additional reinforcements for your castle walls.

Life Insurance: Strategic Wall Fortifications

Cash value in properly structured life insurance policies enjoys significant protection from creditors in many states. This creates a dual benefit: tax-advantaged wealth accumulation and asset protection—like having both stronger walls and additional resources stored within them. However, not all policies are created equal. Many entrepreneurs overpay for underperforming policies sold by commission-motivated “advisors.”

The Drawbridge: Entity Structures That Control Access

A castle's drawbridge controls who can enter and exit. Similarly, proper business entities create controlled access points between your business and personal assets.

The Corporate Veil: Your Drawbridge Mechanism

Many entrepreneurs believe simply forming an LLC provides complete protection. In reality, courts regularly "pierce the corporate veil" when businesses fail to:

- Maintain separate business and personal finances

- Document decisions through proper meeting minutes

- File annual reports and maintain compliance

- Adequately capitalize the business

These failures are equivalent to leaving your drawbridge down and unguarded—inviting attackers directly into your castle.

Multi-Entity Strategies for Maximum Drawbridge Control

For seven to nine-figure entrepreneurs, a single entity is rarely sufficient. Consider:

Operating

Companies

Hold day-to-day business activities with associated liability—the outer drawbridge

Asset Holding

Companies

Own valuable business assets, leasing them to operating entities—an inner drawbridge

Family Limited

Partnerships

Hold investment assets with controlled access—specialty access points

Management

Companies

Centralize operations while distributing risk—drawbridge control mechanisms

This separation creates multiple barriers between potential claims and your valuable assets—like having a series of drawbridges, each requiring different keys and permissions to cross.

Partner Dispute Protection: Defending Against Inside Threats

Surprisingly, the greatest threats to many entrepreneurs' wealth aren't external—they're internal conflicts with business partners, like having enemy agents already inside your castle. Partner disputes often cause more financial damage than outside threats. Consider the bitter dissolution of partnerships like Eduardo Saverin and Mark Zuckerberg at Facebook or Steve Jobs being forced out of Apple in its early days.

Three critical documents prevent most destructive disputes:

Responsibility Matrix

Clearly defines roles, responsibilities, and decision authority—like castle guard assignments

Operating Agreement

Details ownership rights, capital requirements, and financial structures—the castle's operational rulebook

Bylaws/Corporate Governance

Establishes formal procedures for major business decisions—protocols for castle defense

Most importantly, these must include comprehensive exit planning with pre-determined valuation methods and buyout procedures—established protocols for when someone must leave the castle.

The Hidden Vaults:

Trust Structures for Ultimate Protection

The most secure valuables in a medieval castle weren't kept in plain sight—they were stored in hidden chambers with limited access. Similarly, sophisticated trust structures create legal separation between you and your assets.

Domestic Asset Protection Trusts (DAPTs): Inner Chamber Protection

Available in states like Nevada, Delaware, Alaska, and South Dakota, DAPTs offer something remarkable: you can remain a beneficiary of assets while protecting them from future creditors—like having access to your treasures while keeping them in a secret chamber. Setting up these hidden vault structures costs between $5,000-$20,000 initially, with annual maintenance of $2,000-$10,000—a modest investment considering the protection they provide for eight to nine-figure wealth.

Foreign Asset Protection Trusts: Secret Chambers in Distant Lands

For stronger protection, some entrepreneurs use Foreign Asset Protection Trusts in jurisdictions like Nevis, Cook Islands, and Belize. These create jurisdictional hurdles for potential creditors, making assets more difficult to reach—like having your most valuable treasures in hidden vaults located in distant, allied castles. These secret chambers can come with not just a financial cost, which can be upwards of $30,000 per year, but also complexity and confusion. These are best used for large eight to nine-figure net worths.

Building Your Complete Castle Defense Strategy

A comprehensive asset protection strategy requires coordinating all these components while ensuring they work together effectively.

Just as a medieval castle needed architects, builders, and guards working in harmony, your wealth castle requires coordinated professional expertise.

The Cost of Inadequate Castle Defenses

Inadequate asset protection isn't just risky—it's expensive.

Consider the real costs:

- Legal fees for defending against claims (often $250,000+)

- Judgments or settlements exceeding insurance limits

- Business disruption during litigation

- Opportunity costs while managing crises

- Emotional toll and family stress

The Castle Master:

Coordinating Your Defense Strategy

Our Fractional Family Office® model implements these complex strategies without burdening entrepreneurs with details. We coordinate:

-

Insurance Negotiation & Placement: moat construction & maintenance

-

Entity Structure Maintenance: drawbridge mechanisms

-

Trust Administration Coordination: hidden vault access

-

Partnership Document Development: internal castle protocols

-

Ongoing Compliance Monitoring: continuous defense assessment

Most importantly, we ensure all these components work together as a unified system, not as disconnected parts—just as a castle's defenses must work in concert to be truly effective.

When to Build Your Castle Defenses

The most critical aspect of asset protection is timing. Strategies implemented after claims arise are often invalidated as fraudulent transfers—like trying to build castle walls while under attack.

The best time to build your wealth castle was before you needed it. The second-best time is now.

Frequently Asked Questions

When is the right time to implement asset protection strategies?

The best time is now, before any claims arise. Once litigation begins or creditor issues emerge, many strategies become ineffective or potentially fraudulent. Proactive implementation is essential—you can't build castle defenses effectively while under siege.

How is your approach different from typical estate planning?

While estate planning focuses primarily on efficiently transferring assets after death, our comprehensive asset protection strategy focuses on defending your wealth during your lifetime. The integrated castle approach ensures multiple layers of protection work together—something most advisors miss by focusing on isolated strategies rather than a complete defense system.

Can I transfer assets to family members for protection?

Simple transfers to family members often fail to provide adequate protection and may be reversed as fraudulent transfers. Proper strategies using legitimate trusts and business entities provide far stronger protection when implemented correctly and proactively—like having proper vaults and chambers rather than simply hiding treasures in plain sight.

How does asset protection differ for different types of entrepreneurs?

Protection strategies must be tailored to your specific situation. Real estate investors face different risks than service professionals or technology entrepreneurs. Our approach customizes protection based on your industry, assets, and unique risk profile—just as medieval castles were designed differently based on their location, resources, and likely attackers.

Take Action: Build Your Wealth Castle Before It's Too Late

You've spent years building your wealth. Don't leave it vulnerable to threats that proper planning can prevent. Schedule your complimentary Asset Protection Assessment. During this 30-minute consultation, we'll evaluate your current protections, identify vulnerabilities, and recommend specific strategies to fortify your wealth castle.

Disclosure

Dew Wealth Management, LLC ("Dew Wealth"), an SEC-registered investment adviser located in Scottsdale, Arizona, provides the Fractional Family Office® services described herein. Registration does not imply a certain level of skill or ability. All investments involve risk, including the potential loss of principal. Past performance is not indicative of future results. No asset protection strategy can guarantee absolute protection from all claims or liabilities. The information provided is for educational and illustrative purposes only and is not intended as legal, tax, investment or financial advice. The effectiveness of any asset protection strategy depends on your specific circumstances, applicable laws, and proper implementation. Asset protection laws vary significantly by state and can change over time. Strategies described may not be equally effective in all jurisdictions and should be evaluated based on your specific residence and circumstances.

Certain portions of this publication contain a discussion of potential benefits and results. The information presented represents typical asset protection strategies based on general principles, but individual results can and will vary based upon a variety of factors. Different types of investments and strategies involve varying degrees of risk, and there can be no assurance that any specific investment, investment strategy, or product, or any non-investment-related services, will be suitable for your portfolio or individual situation, or prove successful. Neither the scope nor nature of the firm's services should be construed as guarantees of a particular outcome. Dew Wealth does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party and takes no responsibility for same. Client experiences and outcomes will vary from those discussed herein, and these educational materials should not be construed as a direct or indirect guarantee of similar future results. Dew Wealth is neither a law firm nor an accounting firm and does not provide legal or tax advice. Please consult qualified legal and tax professionals regarding your specific situation before implementing any asset protection strategy. References to specific individuals are for illustrative purposes only and do not imply any relationship between these individuals and Dew Wealth Management.

By accessing, using, or receiving this content, you acknowledge and agree to be bound by the terms and conditions outlined at DewWealth.com/IP.