Maximizing

Business Value

The Entrepreneur's Guide to Strategic Exits

For 7 to 9-figure entrepreneurs, your business represents your greatest wealth-building asset—but only if you can convert that success into personal wealth. While you may excel at growing revenue, the real wealth creation often happens when you exit.

This guide reveals the proven frameworks and strategies billionaires use to maximize business value before, during, and after an exit. From entity structuring and tax optimization to team building and deal negotiation, we cover the comprehensive approach needed to transform business success into lasting wealth.

Drawing from our experience guiding entrepreneurs through exits ranging from multi-million-dollar sales to transactions exceeding $1.6 billion, we'll show you how to implement the systematic approach used by the ultra-wealthy to protect and maximize the value you've created. Whether your exit is imminent or years away, the strategies you implement today will determine how much of your hard-earned business value ultimately becomes personal wealth.

The Entrepreneurial Exit Paradox

As an entrepreneur building a successful business, you face a critical reality that often goes unrecognized: running a profitable company doesn't automatically translate to personal wealth. This disconnect creates what we call the "Entrepreneurial Exit Paradox."

Many entrepreneurs find themselves in one of these three scenarios:

The Over-Concentrated Wealth Trap

Your entire net worth is tied to a single, illiquid asset (your business), creating enormous risk with no diversification.

The Lifestyle Business

Ceiling

You've built a company that provides a great income but lacks the systems, structures, and scalability needed for a significant exit.

The Vanishing Value Phenomenon

You've created substantial business value on paper, but when it's time to exit, various factors erode that value before it reaches your personal balance sheet.

"Revenue is vanity, profit is sanity, but cash is king," as Alex Hormozi frequently emphasizes. This principle applies perfectly to business exits—while your revenue might look impressive and your profit margins healthy, what matters is how much cash actually ends up in your pocket after the exit.

Why Most Entrepreneurs

Leave Millions on the Table

The statistics are sobering. According to BizBuySell's Insight Reports, 54% of business sales fall through after entering due diligence. Even worse, our analysis shows that entrepreneurs typically leave 30-50% of their potential exit value on the table due to avoidable mistakes in preparation, timing, and execution. The root cause? Most entrepreneurs approach exits reactively rather than strategically. They focus exclusively on growing their business without building the systems, documentation, and team that would maximize its transferable value.

As Sam Parr and Shaan Puri discussed on the My First Million podcast, "The biggest mistake entrepreneurs make is waiting until they're ready to exit before thinking about exit strategy. By then, it's usually too late to implement the changes that would have doubled their valuation."

Understanding Business Value

Beyond Revenue & EBITDA

Before you can maximize your exit, you need to understand what truly drives business value. While many entrepreneurs focus solely on revenue or EBITDA, the reality is far more nuanced.

8 Value Drivers

That Actually Matter

When we assess business value with our clients, we examine eight critical factors that determine what buyers are willing to pay:

Financial Performance

Revenue growth, profit margins, and cash flow consistency

Growth Potential

Scalability, market opportunity, and expansion capabilities

Transferable Systems

Documented processes that don't rely on the owner

Customer Diversification

Reduced dependency on a small number of clients

Competitive Advantage

Unique selling proposition and market positioning

Management Team

Strong leadership that will remain post-exit

Recurring Revenue

Predictable, subscription-based income streams

Owner Dependency

The degree to which the business relies on your personal involvement

The Multiple Effect

Small Improvements, Massive Results

What makes business value optimization so powerful is the "multiple effect." When you increase your EBITDA by $100,000 and your business sells for a 5x multiple, that's an additional $500,000 in exit value.

Even more impactful, if you can increase your multiple from 3x to 5x on $1 million in EBITDA, that's a $2 million increase in total value. This multiplier effect is why a systematic approach to building business value delivers exponential results compared to simply focusing on revenue growth.

The Billionaire Blueprint Pre-Exit Strategies

Billionaires understand that maximizing business value begins years before any transaction. They implement sophisticated strategies designed to optimize both business value and post-exit wealth. As venture capitalists like Chamath Palihapitiya have discussed on the All-In podcast, exit planning is fundamentally about creating maximum value, optionality, and after-tax proceeds—not just the exit itself.

Entity Structuring for Tax-Efficient Exits

The way your business is structured fundamentally impacts your exit options and after-tax proceeds.

Yet many entrepreneurs operate with entity structures that severely limit their exit potential.

Key Entity Strategies:

- Strategic C-Corporation Conversions: Leverage Section 1202 qualified small business stock exclusions to potentially eliminate federal taxes on up to $10 million in gains (or 10x your initial investment, whichever is greater)

- F Reorganizations: Create holding company structures that provide flexibility in transaction structure while maintaining tax efficiency

- Multiple Entity Frameworks: Separate intellectual property, real estate, and operating companies to maximize value and minimize risk

"Before I met Jim and the team at Dew Wealth, I had no idea how much impact my entity structure would have on my eventual exit. They were instrumental in guiding myself and my partners with tax and asset protection through this process."

Brad Baumgardner, who recently sold his business to Blackstone for $1.6B

Unpaid client testimonial

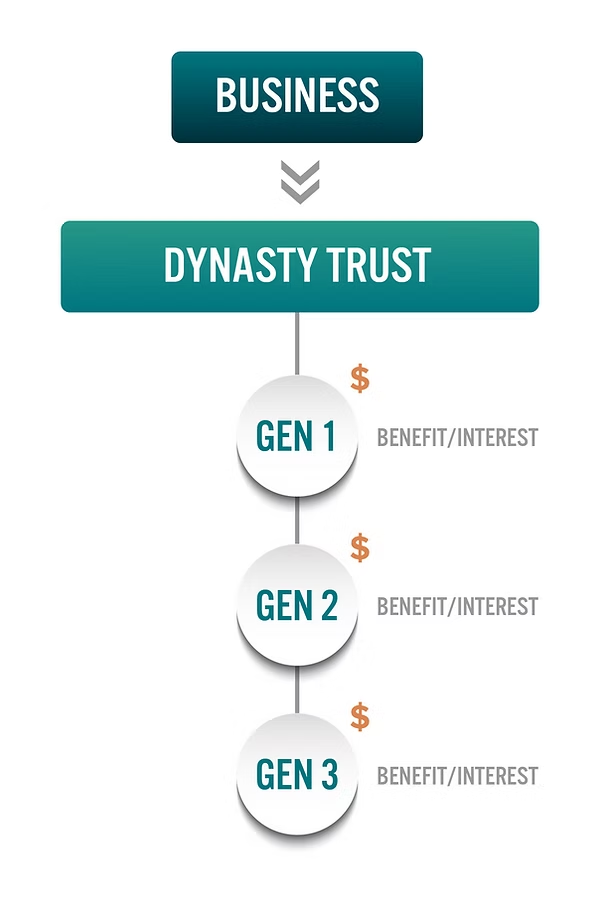

Estate & Legacy Integration

For many entrepreneurs, an exit represents a once-in-a-lifetime wealth event that impacts not just their financial future, but their family's legacy for generations. Integrating estate planning with exit strategy is where billionaires excel.

Key Pre-Exit Estate Strategies:

- Dynasty Trust Implementation: Establish asset protection and estate tax avoidance structures before significant value increases

- Intentionally Defective Grantor Trusts (IDGTs): Transfer business interests to future generations while maintaining income tax responsibility and control

- Spousal Lifetime Access Trusts (SLATs): Remove business assets from your taxable estate while maintaining indirect access through your spouse

Pre-Exit Tax Optimization

Tax strategy represents perhaps the greatest opportunity to preserve wealth during a business exit. The difference between a reactive and proactive approach can literally be millions of dollars.

Essential Tax Strategies:

- Tax-Loss Harvesting Strategies: Build a reserve of capital losses to offset future exit gains with sophisticated long/short trading strategies

- Qualified Opportunity Zone Investments: Defer, reduce, and potentially eliminate taxes on capital gains

- Charitable Planning: Integrate donor-advised funds, charitable remainder trusts, charitable lead trusts, and even private foundations to reduce tax burden while fulfilling philanthropic goals

"We're looking to exit our company in the next couple years. Bryce and team have been amazing helping our CFO with connections and bankers. The strategies they've put in place have already saved us significantly in taxes while positioning us for maximum value."

Nick Daniel, CEO of a nine-figure business

Unpaid client testimonial

Building Your Exit Dream Team

A successful exit requires more than just a great business—it demands a coordinated team of experts working in harmony. Like a championship sports team, each professional plays a specific position, but they must function as a cohesive unit.

The Core Exit

Team Members

Investment Banker/Business Broker

The quarterback of your transaction team who:

Prepares marketing materials showcasing your business

Identifies qualified buyers and creates competitive tension

Manages the auction process to maximize value

Navigates negotiations to optimize deal terms

M&A Attorney

Your legal protection who:

Structures the transaction to minimize risk

Reviews and negotiates all agreements

Protects your interests through representations and warranties

Ensures proper handling of liabilities and contingencies

Tax Strategist

Your financial optimizer who:

Implements pre-transaction tax planning

Structures the deal for maximum after-tax proceeds

Coordinates post-close tax strategies

Ensures compliance with all tax regulations

Quality of Earnings (QoE) Specialist

Your financial validator who:

Conducts thorough analysis of financial statements beyond standard audit procedures

Identifies adjustments to EBITDA that impact valuation

(add-backs, one-time expenses, etc.)

Validates revenue recognition and the sustainability of earnings

Provides credibility to your financial reporting that buyers rely on during due diligence

"Operating as an entrepreneur, you can feel like you're on an island. A lot of times it is a lonely feeling and there aren't many people that you can turn to for guidance or advice. Working with Dew Wealth I feel like I have really a guide to work with, an advisory team that I can turn to for both personal and business decisions."

Craig Collins, Earth Echo

Unpaid client testimonial

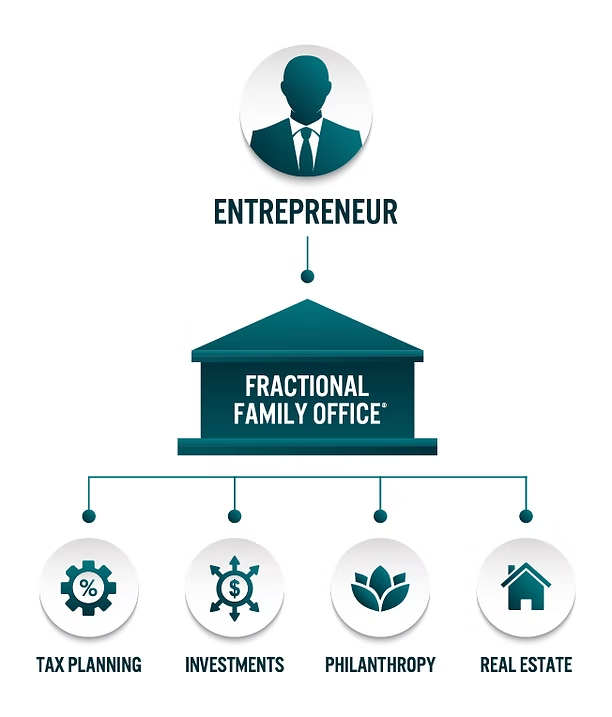

The Fractional Family Office® Advantage

Billionaires solve the team coordination challenge through family offices that manage every aspect of their wealth, including business exits. But with traditional family offices costing $2 million+ annually, they've been inaccessible to most entrepreneurs. That's why we created the Fractional Family Office® model, bringing the same comprehensive approach to successful entrepreneurs without the massive overhead costs.

See If You Qualify with Our Wealth Waste Calculator®

.avif)

"I was very aware that I could go through that pretty quick if I didn't have a plan. When I came into a significant amount of money in my early 40s, I knew I needed experts to guide me through both the exit and what came after."

Will Humphreys, who successfully exited his healthcare practice

Unpaid client testimonial

Exit Pathways Choosing Your Optimal Route

Just as there are multiple routes to the same destination, there are multiple ways to exit your business. The key is selecting the path that best aligns with your financial goals, timeline, and legacy objectives.

External Exit Options

Strategic Acquisition

- Optimal For: Businesses with strategic value to larger players in their industry

- Typical Valuation: Highest multiples (often 5-10x EBITDA or more) due to synergistic value

- Timeline: 6-12 months from engagement to close

- Key Consideration: Cultural alignment and employee impact

Private Equity Acquisition

- Optimal For: Businesses with strong cash flow and growth potential

- Typical Valuation: Competitive multiples (4-8x EBITDA) depending on sector and growth

- Timeline: 6-9 months from engagement to close

- Key Consideration: Potential for rollover equity and second bite of the apple

Search Fund / Individual Buyer

- Optimal For: Smaller businesses or those with simpler models

- Typical Valuation: More modest multiples (3-5x EBITDA) but potentially better cultural fit

- Timeline: 3-9 months from engagement to close

- Key Consideration: Financing capabilities and transition period

Internal Exit Options

Management Buyout (MBO)

- Optimal For: Businesses with strong management teams capable of taking over

- Typical Valuation: Usually lower multiples but better terms and longer payout periods

- Timeline: Can be structured over several years

- Key Consideration: Management team's ability to secure financing

Employee Stock Ownership Plan (ESOP)

- Optimal For: Businesses with strong culture and desire to preserve legacy

- Typical Valuation: Fair market value with significant tax advantages

- Timeline: 6-12 months initial setup, with transitions often phased over years

- Key Consideration: Tax benefits vs. complexity and ongoing administration

Family Succession

- Optimal For: Family businesses with capable next-generation leadership

- Typical Valuation: Often based on estate planning & gifting strategies rather than maximum value

- Timeline: Multi-year planning and transition

- Key Consideration: Family dynamics and equitable treatment of all family members

Recapitalization / Passive Ownership

- Optimal For: Entrepreneurs who want liquidity but aren't ready for full exit

- Typical Valuation: Extract equity while maintaining control or transitioning to passive role

- Timeline: Varies based on structure and goals

- Key Consideration: Balancing current liquidity needs with long-term growth potential

"During COVID, Dew Wealth was there for me with EIDL, PPP, and everything I needed to make sure that I got the most opportunity to succeed through that very tough time. When it came time to exit, they helped me find the path that matched not just my financial goals, but what I wanted my legacy to be."

Mike Arce, Founder of Loud Rumor

Unpaid client testimonial

The Exit Timeline

A Strategic Approach

A successful exit requires methodical preparation and execution. Below is the optimal timeline framework we use with our clients to ensure maximum value.

P H A S E O N E

Strategic Preparation

(12-24 Months Pre-Exit)

During this critical phase, focus on the fundamental improvements that will maximize your business value:

Implement financial reporting systems that provide clear, accurate, and timely information

Reduce owner dependency by building and documenting systems and processes

Strengthen your management team and ensure key employees have retention incentives

Optimize entity structure and implement pre-exit tax strategies

Address potential due diligence red flags before they become issues

P H A S E T W O

Market Readiness

(3-6 Months Pre-Market)

As you prepare to enter the market, this phase focuses on positioning your business for maximum appeal:

Select and engage with your investment banker or business broker

Prepare comprehensive marketing materials and financial models, including quality of earnings

Identify and research potential strategic and financial buyers

Develop your communication strategy for employees, customers, and vendors

Create your ideal structure for the transaction

P H A S E T H R E E

Market & Deal Execution

(4-8 Months)

This active phase moves from initial marketing through closing:

Implement confidential marketing process to qualified buyers

Review and negotiate Letters of Intent (LOIs)

Manage comprehensive due diligence process

Negotiate final purchase agreement and deal terms

Coordinate closing process and transition planning

"You can do it yourself or you can do it with a bunch of experts who know what they're doing. The time and frustration you save working with an organization that actually understands exactly what you're going through...it's definitely one of the best decisions I've ever made."

Samantha Guthrie, who successfully exited her business

Unpaid client testimonial

Post-Exit Wealth Management Preserving Your Legacy

The work doesn't end at closing—in many ways, it's just beginning. The most successful entrepreneurs approach post-exit wealth management with the same strategic mindset they applied to building their businesses.

The Post-Exit Wealth Plan

Immediate Post-Close Priorities

- Cash Flow Management: Establish systems to ensure your money lasts throughout your lifetime

- Investment Strategy: Implement the "billionaire investment allocation" strategy for diversification

- Tax Efficiency: Continue proactive tax planning to preserve wealth

- Risk Management: Protect your new liquidity through proper asset protection

Long-Term Wealth Preservation

- Family Governance: Establish systems for multi-generational wealth management

- Legacy Planning: Design and implement your charitable and family legacy

- Wealth Education: Prepare the next generation for responsible stewardship

- Lifestyle Sustainability: Balance enjoying your wealth with preserving it

"Once you start to accumulate and build wealth, it's a whole other thing. Earning it is one thing, but keeping it is more important. I've absolutely loved working with Dew Wealth and their team. I honestly don't see myself ever not working with them."

Brandon Poulin, who built a company that's appeared on the Inc. 5000 list twice

Unpaid client testimonial

Common Exit Planning Mistakes to Avoid

Through our work with hundreds of entrepreneurs, we've identified the most costly mistakes made during exit planning. Being aware of these pitfalls can save you millions.

Waiting Too Long to Start Planning

Many entrepreneurs believe exit planning only matters when they're ready to sell. This costly misconception leads to rushed decisions and suboptimal outcomes. Strategic exit planning ideally begins 3-5 years before any transaction to maximize value and optionality.

Focusing Solely on Sale Price

While headline valuation matters, deal structure often has a greater impact on how much money actually reaches your pocket. Terms like earnouts, seller financing, representations and warranties, working capital adjustments, and escrow arrangements can significantly affect your net proceeds.

Neglecting Tax Planning

Taxes can consume 30-50% of your exit proceeds without proper planning. Strategic pre-transaction tax planning can legitimately reduce or defer this burden, often saving millions. Once a letter of intent is signed, many tax strategies become unavailable.

Maintaining Owner Dependency

If your business can't operate without you, its value is severely limited. Buyers pay premiums for businesses with strong management teams and documented systems that will continue to function after the founder departs.

Mismanaging the Due Diligence Process

Due diligence is where deals often fall apart. Unprepared entrepreneurs find themselves scrambling to provide documentation, explain discrepancies, or address issues they didn't anticipate. Proactive due diligence preparation identifies and resolves potential problems before they threaten your deal.

"Working with Dew Wealth has been one of those investments where the tax savings you're gonna achieve in year one or some of the additional savings you can have or increased sales is more than worth it. I would encourage you to give it a try. I think you'll be more than blown away by all of the efficiencies and all of the support that you'll find throughout that journey."

Jordan Linscombe, Owner & Entrepreneur: Something New Brand of Companies

Unpaid client testimonial

The Path Forward

Building and exiting a successful business represents one of the most significant wealth creation opportunities available to entrepreneurs. Yet without proper planning and execution, much of the value you've created can slip away through avoidable taxes, suboptimal deal structures, or inadequate preparation.

The billionaire approach to business exits combines strategic foresight, sophisticated planning, and coordinated execution across multiple disciplines. By implementing these same strategies through a Fractional Family Office® model, you can achieve similar results without requiring billionaire-level wealth.

Whether your exit is imminent or years away, the actions you take today will directly impact your ultimate outcome. The entrepreneurs who achieve exceptional results don't leave their exits to chance—they implement systematic processes designed to maximize value, minimize taxes, and create lasting legacies.

.avif)

"I can't say enough about these guys. It's been an absolute godsend for us. They've been amazing helping our CFO with connections and bankers. The strategies they've put in place have already saved us significantly in taxes while positioning us for maximum value."

Nick Daniel, CEO of a nine-figure business preparing for exit

Unpaid client testimonial

Frequently Asked Questions

How early should I start planning my exit strategy?

Ideally, exit planning begins 3-5 years before any anticipated transaction. This timeline allows for implementing value-enhancement strategies, optimizing tax structures, building management depth, and addressing potential due diligence issues. Even if you have no immediate plans to exit, having a strategy in place provides options should circumstances change unexpectedly.

What's the difference between strategic buyers and financial buyers?

Strategic buyers are typically companies in your industry or adjacent markets looking to acquire your business for synergistic value. They often pay higher multiples but may have specific integration plans that impact your team and culture. Financial buyers, like private equity firms, purchase businesses primarily as investments. They may offer lower initial valuations but could provide opportunities for you to retain equity and potentially benefit from a "second bite of the apple" in a future transaction.

How do I know if my business is ready for an exit?

Business exit readiness can be evaluated across several dimensions: financial performance (steady growth and profitability), operational systems (documented processes that don't depend on the owner), management depth (strong leadership beyond the founder), market position (sustainable competitive advantage), and industry timing (favorable market conditions).

How much experience does Dew Wealth have with business exits?

We've guided dozens of entrepreneurs through exits ranging from small seven-figure transactions to complex deals exceeding $1.6 billion. Our experience spans various industries and transaction types, including strategic sales, private equity recapitalizations, ESOPs, and even management buyouts. We don't just advise on exits—we build comprehensive teams around our clients to ensure optimal outcomes.

Do I need to replace my current advisors to work with your Fractional Family Office®?

No. Our approach is designed to complement your existing team of trusted professionals. We often work alongside clients' current attorneys, CPAs, and other advisors, providing coordination and specialized expertise while ensuring everyone moves in alignment toward your goals. In situations where gaps exist in your advisory team, we can recommend specialists from our network of over 500 vetted professionals who excel in working with entrepreneurs at your level.

What if I'm not sure I want to exit my business?

Exit planning isn't exclusively about selling your business—it's about creating options. By implementing the strategies we outline, you're building a more valuable, transferable business with less owner dependency. This gives you the freedom to choose your path: sell to an outside buyer, transition to family members, empower your management team to take ownership, or simply reduce your day-to-day involvement while maintaining ownership. The goal is maximum optionality and value, regardless of your ultimate decision.

How do you typically charge for exit planning services?

Unlike many exit planners who charge success fees or commissions (creating potential conflicts of interest), we operate on a transparent fixed-fee model through our Fractional Family Office®. This ensures we're incentivized to provide strategies that work for your long-term benefit, not just to close a transaction. Our services are designed for entrepreneurs generating $1M+ in annual revenue, with specific scope and pricing tailored to your unique situation after an initial assessment.

Explore These Strategies

Ready to explore how these strategies apply to your specific situation? Take the first step by completing our Wealth Waste Calculator to identify your biggest opportunities and gaps in your current exit planning approach.

Disclosure

Dew Wealth Management, LLC ("Dew Wealth") is an SEC-registered investment adviser located in Scottsdale, Arizona. Registration does not imply a certain level of skill or training. The information provided in this material is for general informational and educational purposes only and should not be construed as personalized investment, tax, or legal advice. All investing involves risk, including the potential loss of principal. This material contains testimonials by clients of Dew Wealth. The testimonials were not compensated, solicited, or edited by Dew Wealth. These testimonials may not be representative of the experience of other clients, and are not indicative of future performance or success. Results vary depending on each client's specific financial situation, needs, goals, and objectives.

References to "billionaire" strategies, approaches, or investment allocations reflect general concepts and principles that may be employed by high-net-worth individuals and are provided for illustrative purposes only. No representation is being made that any client will or is likely to achieve the same or similar results as those shown. Specific business exit valuations, multiples, and timelines mentioned (e.g., "5-10x EBITDA" or "6-12 months from engagement to close") are for general educational purposes only and represent typical ranges based on industry observations. Actual exit valuations and timelines depend on numerous factors including but not limited to industry, market conditions, company size, profitability, growth rate, competitive landscape, and other variables specific to each business. Any discussion of tax matters contained herein is not intended or written to be used, and cannot be used, for the purpose of avoiding tax penalties. Any statements regarding tax strategies, entity structuring, or tax optimization should be reviewed with qualified tax professionals before implementation. Dew Wealth Management, LLC does not provide legal or tax advice. Coordination with qualified legal and tax professionals is strongly recommended for implementation of exit planning strategies. References to specific investment structures, trusts, or other wealth management vehicles are educational in nature and do not constitute a recommendation for any specific individual. Dew Wealth does not guarantee that implementing the described strategies will result in improved exit valuations, tax benefits, or wealth preservation.

Third-party quotes, statistics, or references to external sources are included for informational purposes only, and Dew Wealth does not endorse or guarantee the accuracy of such information. The Fractional Family Office® and Wealth Waste Calculator® are registered service marks of Dew Wealth Management, LLC. Past performance does not guarantee future results. The value of investments may fluctuate and can go down as well as up. Clients may not get back the amount originally invested. Forward-looking statements or projections are not guaranteed and actual results may differ materially.

By accessing, using, or receiving this Document, the Recipient acknowledges and agrees to be bound by the terms and conditions outlined at DewWealth.com/IP.