Investing Beyond

Main Street

How Entrepreneurs Can Invest Like Billionaires

Tony Robbins

Executive Investments

For successful entrepreneurs, the financial skills that built your business rarely translate to investment success. While traditional financial advisors push the same "Main Street" investment strategies used by everyday investors—typically a standard mix of stocks and bonds—billionaires employ dramatically different approaches that produce superior results. Through family office structures, the ultra-wealthy access sophisticated investment opportunities providing true diversification and potentially higher risk-adjusted returns.

The stark reality is that most entrepreneurs are handicapped by a traditional investment system not designed for their unique needs. As documented by Tony Robbins in his extensive research interviewing over 50 of the world's financial elite for his book The Holy Grail of Investing, billionaires allocate 40-60% of their portfolios to alternative investments—an approach that consistently outperforms conventional strategies. Yet most entrepreneurs lack access to these opportunities due to systemic limitations in the financial advisory industry.

This guide reveals how accomplished entrepreneurs can implement these same billionaire investment strategies without needing a billion-dollar net worth. Through our Fractional Family Office® approach, we help 7-9 figure entrepreneurs break free from conventional investment limitations, providing access to the diverse asset classes and sophisticated strategies previously available only to the ultra-wealthy. The result is a resilient portfolio built to preserve and grow wealth through any economic environment—just like billionaire family offices have done for generations.

See If You Qualify with Our Wealth Waste Calculator

Alex Hormozi

The Entrepreneur's Investment Paradox

Why Your Business Success Could Be Your Biggest Investment Liability

The very traits that fueled your entrepreneurial success could be undermining your investment returns. Think about what made you successful in business:

- Trusting your instincts

- Moving quickly and staying agile

- Maintaining direct control

- Taking calculated risks in your area of expertise

- Being decisive and action-oriented

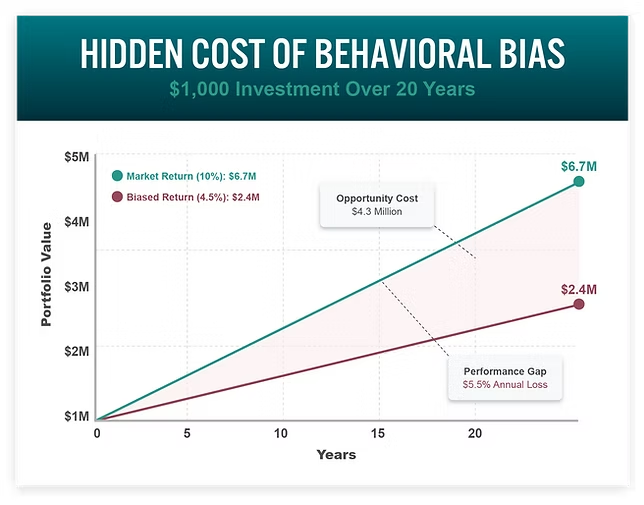

Yet in the investment world, these same traits often lead to poor decisions and missed opportunities. According to research from DALBAR's Quantitative Analysis of Investor Behavior (QAIB), the average investor underperforms the market by approximately 4.3% annually due to behavioral factors—a staggering difference that compounds into millions in lost wealth over time.

As Alex Hormozi often emphasizes in his content, "What got you here won't get you there." The mindset and strategies that built your business require a complete reset when it comes to building an investment portfolio that preserves and grows your wealth.

"I was struggling with doing personally and also doing a very poor job at managing my investments. I didn't understand the magnitude of some of the stuff they've implemented...the tax saving strategies, the investment strategies that they've helped implement for me, it's just been a complete game changer."

Steve Harward, Founder & CEO of Prime Corporate Services

Unpaid client testimonial

The Risk Paradox

Taking the Wrong Risks

While entrepreneurs are natural risk-takers in business, they face a peculiar contradiction in their investment approach. Research shows they often become overly conservative with their investment portfolios while maintaining enormous concentration risk in their businesses. This creates a dangerous disconnect:

Taking excessive risk through concentrated business positions

Being too conservative with investment capital outside the business

Missing opportunities for true diversification across asset classes

Failing to optimize risk-adjusted returns through proper allocation

This paradox was highlighted by many successful investors who observe that founders often have "all their eggs in one basket with their company, then keep their investment capital in cash because they're afraid of losing it."

This approach ultimately leads to suboptimal returns and increased overall risk.

Discover How Much You're Leaving on the Table with Our Wealth Waste Calculator

The Hidden Cost of Behavioral Biases

The same psychological traits that drive business success can lead to costly investment mistakes:

Control Bias

Entrepreneurs' need for control often leads to overtrading and market timing attempts. A study by Brad Barber and Terrance Odean published in the Journal of Finance found that active traders underperform the market by approximately 6.5% annually due to excessive trading.

Overconfidence

Business success creates false confidence in investment abilities. This manifests in concentrated positions and insufficient diversification.

Familiarity Bias

The tendency to invest only in known industries or businesses. As Sam Parr of My First Million podcast has discussed in multiple episodes, entrepreneurs tend to invest in what they know— tech founders invest in tech startups, real estate developers in more properties, and so on.

Recency Bias

Giving too much weight to recent market events, leading to buying high and selling low—the opposite of successful investing.

According to DALBAR's 2023 Quantitative Analysis of Investor Behavior (QAIB) and Morningstar's "Mind the Gap" study, these behavioral biases cost investors between 1.7% and 5.5% in annual returns depending on asset class—potentially millions in lost wealth over time. For entrepreneurs who have worked tirelessly to build successful businesses, this represents an enormous opportunity cost.

Why Traditional Investment Models Fail Entrepreneurs

The Broken 401(k) Model

The conventional wisdom of "save in your 401(k) for 40 years" wasn't designed for entrepreneurs. Your wealth-building journey looks fundamentally different. You need investment strategies that:

- Account for irregular cash flows from business operations

- Complement your existing business risk profile

- Provide strategic liquidity for opportunities and obligations

- Offer tax efficiency aligned with your complex situation

- Scale alongside your growing wealth

On investment podcasts and shows like All-In, investors have often discussed how the traditional financial system was built primarily for W-2 employees with predictable incomes and simpler financial lives—not for entrepreneurs with complex situations.

The Traditional Access Problem

Even when entrepreneurs seek investments beyond stocks and bonds, they face significant hurdles:

- High placement fees (3-5%) that immediately reduce investment capital

- Brokers operating under "suitability" rather than fiduciary standards

- Limited due diligence support with potential conflicts of interest

- No coordination between different investments or overall strategy

- Lack of ongoing monitoring and risk management

Access to quality alternative investments isn't just about having capital to invest—it's about having the network, knowledge, and team to properly evaluate these opportunities. Most traditional financial advisors simply can't provide that level of access or analysis.

.avif)

"Before working with them, I had a lot of headaches. I had my hands in a lot of different businesses and real estate investments. They helped me see a number of blind spots I had and weaknesses in my overall financial plan."

Chris Jones, Vice President of Speedrack West

Unpaid client testimonial

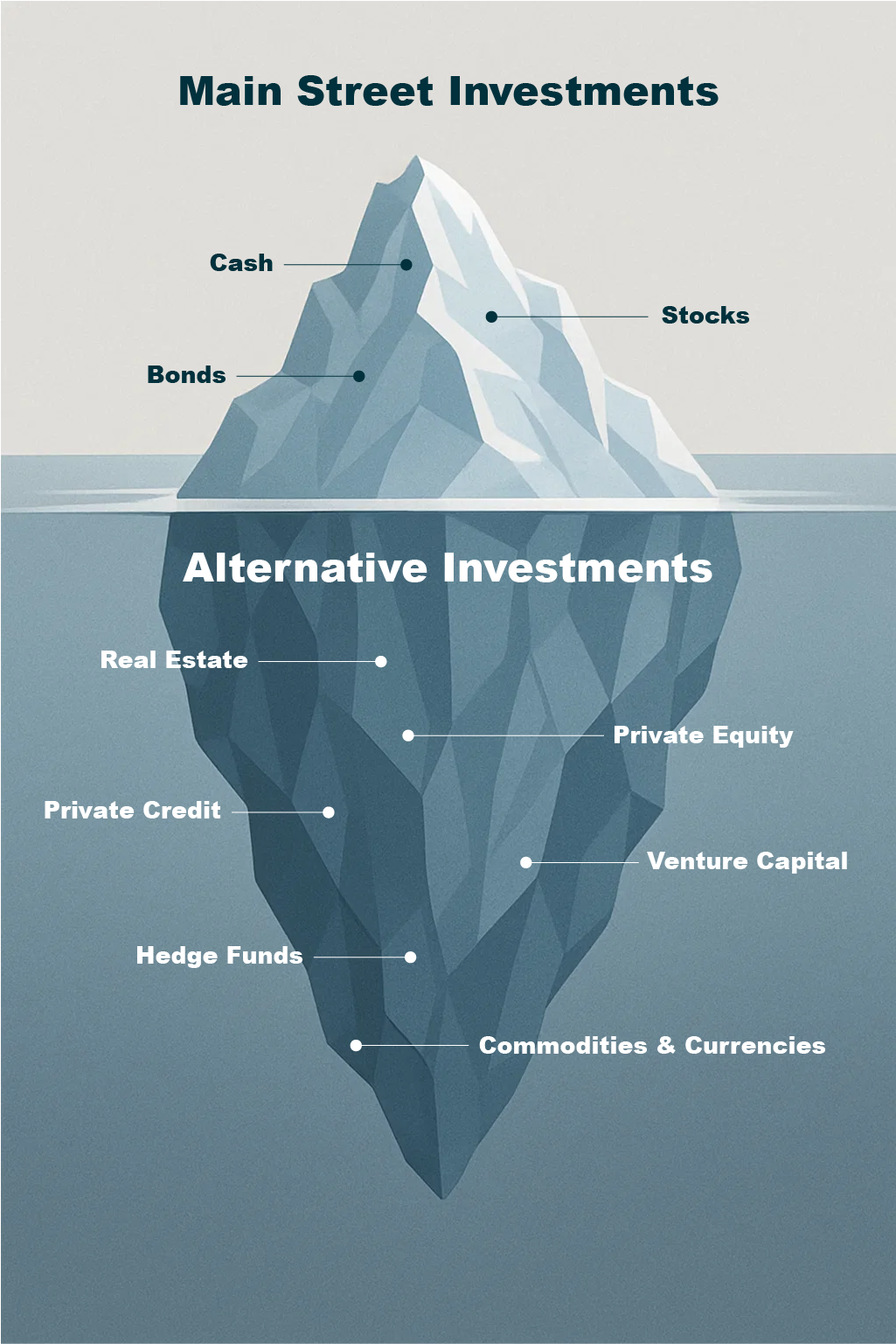

Why Most Financial Advisors Only Offer "Main Street" Investments

Traditional financial advisors typically limit you to publicly traded stocks and bonds—what we call "Main Street" investments. But why? The answer reveals fundamental conflicts in the traditional advisory model:

Limited Access to Alternative Investments

Most traditional advisors have restricted access to the alternatives that billionaires use to build wealth. They operate within frameworks limited to publicly traded assets, missing the private markets where significant wealth creation occurs.

Limited Knowledge About Alternative Investments

Many advisors simply lack expertise beyond traditional asset classes. Their training focuses on stocks and bonds, leaving them uncomfortable recommending investments they don't fully understand.

Misaligned Incentives Due to Fee Structures

The standard 1% assets under management (AUM) fee creates inherent conflicts. Advisors are incentivized to:

- Keep your money in assets they can manage and charge fees on

- Discourage investments in real estate, private businesses, or other alternatives

- Maximize assets under management rather than optimizing your wealth strategy

- Focus on gathering assets rather than generating superior returns

Tony Robbins documented this issue extensively in his research. After interviewing dozens of the world's greatest investors, he concluded that "the great deception of traditional financial advice is the illusion of diversification within a narrow band of highly correlated assets."

As an entrepreneur, you need more than this limited approach. You need the comprehensive, sophisticated strategies that billionaires have used for generations.

How Billionaires Solved These Problems

The Family Office Solution

The Billionaire Blueprint

Billionaires faced these same investment challenges and solved them by creating family offices—dedicated teams of professionals focused solely on managing and growing their wealth. This structure:

Disciplined Execution

Removes emotional decision-making through systematic processes.

Rigorous Evaluation

Provides sophisticated due diligence on all investment opportunities

Exclusive Access

Enables access to exclusive private market investments

Intentional Diversification

Ensures proper diversification across multiple asset classes

Tax Optimization

Maintains tax efficiency throughout the investment process

Integrated Coordination

Coordinates complex wealth strategies across all holdings

The evidence of this approach's effectiveness is undeniable. Yale's endowment, under David Swensen's leadership, generated returns of 11.3% annually over 30 years according to Yale Investments Office public reports—significantly outperforming traditional portfolios during the same timeframe—by implementing this diversified approach with significant allocations to alternatives.

.avif)

"I've counted on Dew Wealth for quite a while to help me watch the back doors to make sure I'm just not doing things that I wouldn't even see, so I trust them implicitly."

Dave Asprey, Founder of Bulletproof (over $500 million in revenue)

Unpaid client testimonial

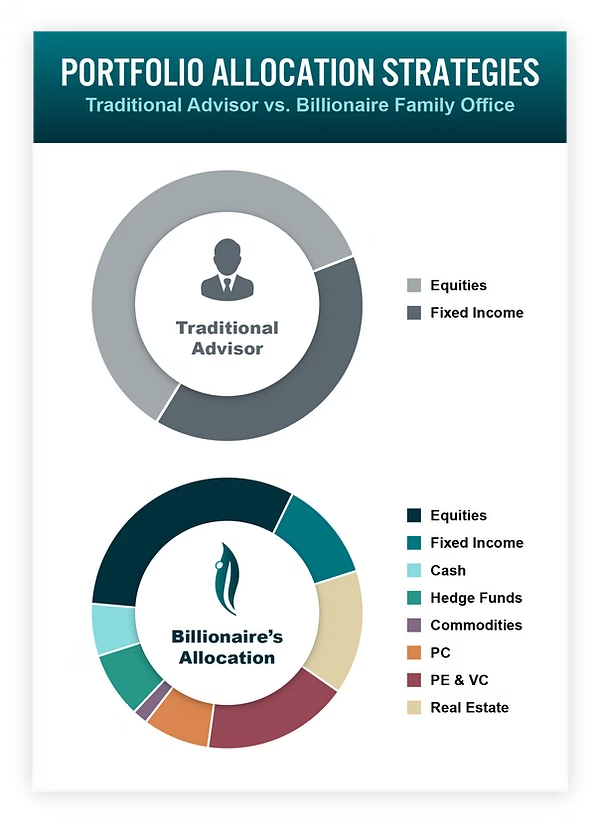

The Billionaire Asset Allocation A Different Path

By implementing this systematic approach, billionaires invest dramatically differently than the average investor. According to the latest Global Family Office Report and UBS studies:

40-60% in Alternative Investments

- 20-25% private equity and venture capital

- 10-15% real estate (direct and funds)

- 5-10% hedge funds and managed futures

- 5-10% other alternatives (art, commodities, etc.)

40-60% in Traditional Investments

- 25-30% public equities (global allocation)

- 15-20% fixed income

- 5-10% cash and equivalents

This diversified approach provides:

- Better risk-adjusted returns through uncorrelated assets

- Lower overall portfolio volatility

- Enhanced tax efficiency via strategic holding structures

- Greater wealth preservation through economic cycles

- Access to "alpha" opportunities in inefficient markets

As Tony Robbins discovered through his research with the world's top investors, "The ultra-wealthy don't put all their eggs in one basket of publicly traded stocks and bonds. They diversify across multiple asset classes and investment types to create true resilience."

The Fractional Family Office® Solution

Investing Like a Billionaire Without Being One

Most entrepreneurs assume they need a billion-dollar net worth to access these sophisticated strategies. That's no longer true. Our Fractional Family Office® brings these same investment approaches to successful entrepreneurs through a systematic process:

Step 1: Benchmark & Review Your Current Investments

Before making any changes, we conduct a comprehensive analysis of your existing portfolio:

- Unlock alternative investments like the ultra-wealthy to multiply your money

- Apply advanced tax strategies to keep more of what you make

- Protect your wealth with elite asset protection tools

- Access a powerful network of world-class professionals

This assessment often reveals surprising insights. Many entrepreneurs discover they're paying far more in fees than they realized—sometimes 2-3% annually when all costs are tallied—while taking either too much or too little risk relative to their goals.

Step 2: Map Your Current Allocation Against the Billionaire Model

Once we understand your current investments, we map them against typical billionaire allocations to identify gaps and imbalances:

- Create detailed asset allocation map across all investment categories

- Identify concentration risks and diversification opportunities

- Compare your current allocation to billionaire models

- Determine whether any imbalances are strategic or accidental

- Develop clear targets for optimal allocation based on your specific situation

This mapping process typically reveals significant deviations from optimal allocations. We commonly find entrepreneurs with 70-80% of their investments concentrated in a single asset class, often something adjacent to their business experience.

Step 3: Design Your Custom Billionaire's Allocation® & Implementation Plan

With a clear understanding of your current position and the gaps that exist, we create a multi-year investment plan with targeted allocations:

-

Develop a custom allocation strategy based on your specific situation

-

Create a systematic implementation timeline to minimize taxes and costs

-

Establish proper investment vehicles and structures

-

Determine appropriate liquidity provisions

-

Integrate tax planning with investment strategy

This isn't a one-size-fits-all approach. Your ideal allocation depends on your time horizon, liquidity needs, risk tolerance, tax situation, and goals.

Step 4: Methodical Implementation & Rigorous Vetting

The final step is executing your plan with discipline and rigor:

- Create detailed asset allocation map across all investment categories

- Identify concentration risks and diversification opportunities

- Compare your current allocation to billionaire models

- Determine whether any imbalances are strategic or accidental

Our investment team applies a rigorous 50-point checklist to every potential investment, analyzing everything from team experience and track record to fee structures and exit strategies. This process has helped our clients avoid numerous problematic investments that looked attractive on the surface but contained hidden risks.

See What You're Missing with Our Wealth Waste Calculator

.avif)

"I had never seen a model for advisory in the way that they ran it. I have a peace of mind around my finances, my insurance, my assets protection, my taxes and all of that stuff because they're constantly working on my behalf."

Pete Vargas, Entrepreneur

Unpaid client testimonial

Beyond the Basics

Advanced Strategies That Transform Entrepreneur Wealth

After establishing a strong foundation through proper asset allocation and investment access, successful entrepreneurs can further amplify their wealth through sophisticated strategies often reserved for billionaires.

Private Equity & Venture Capital: The Billionaire's Edge

Private market investments represent one of the most significant differences between billionaire portfolios and traditional investments. According to Cambridge Associates' Private Equity and Venture Capital Index, top-quartile private equity funds have outperformed public markets by 4-8% annually over the past 25 years, as reported in their long-term investment performance benchmarks.

Our approach provides entrepreneurs with:

- Access to vetted private equity and venture opportunities

- Proper position sizing and diversification

- Comprehensive due diligence and ongoing monitoring

- Integration with overall portfolio strategy

As discussed frequently on shows like My First Million, the significant wealth creation often happens in private markets before companies go public. By the time most retail investors can access these companies, the extraordinary early returns have already been captured by private investors.

Strategic Real Estate: Beyond Single-Family Rentals

While many entrepreneurs invest in real estate, billionaires take a more sophisticated approach:

- Commercial real estate in multiple sectors

- Real estate syndications and funds

- Real estate debt and preferred equity

- International real estate for diversification

- Tax-advantaged real estate strategies

Through our Fractional Family Office®, entrepreneurs gain access to institutional-quality real estate opportunities previously available only to the ultra-wealthy, with minimum investments often 5-10x lower than direct access would require.

Tax-Efficient Investment Structures

As an entrepreneur, taxes are likely your largest expense. Strategic tax planning through proper investment structuring can save millions over time:

- Self-directed IRAs for alternative investments

- Private Placement Life Insurance (PPLI)

- Strategic asset location across accounts

- Tax-loss harvesting protocols

- Opportunity zone investments

Risk-Adjusted Return Focus

Rather than chasing the highest projected returns, we help entrepreneurs optimize their risk-adjusted returns through:

- Modern Portfolio Theory application

- Correlation analysis across all holdings

- Risk factor decomposition

- After-tax return optimization

- Regular portfolio rebalancing

By focusing on risk-adjusted returns rather than absolute returns, billionaires build portfolios that deliver consistent performance through varying market conditions. This approach is particularly valuable for entrepreneurs who need to preserve the wealth they've worked so hard to build.

.avif)

"They were able to put in tax strategies to save me hundreds of thousands of dollars. Take it from a high-net-worth individual who's gotten massive value."

Joel Marion, Co-Founder of BioTrust Nutrition

Unpaid client testimonial

The Fiduciary Difference

Investment Advice Without Conflicts

One crucial aspect that sets billionaire family offices apart is their complete alignment with the family's interests. Unlike traditional advisors who earn commissions or kickbacks for recommending specific investments, family offices operate as True Fiduciaries—legally obligated to act solely in their clients' best interests.

Our Fractional Family Office® brings this same fiduciary approach to entrepreneurs:

- No commissions or kickbacks from investment recommendations

- No hidden fees or revenue sharing arrangements

- No proprietary products with embedded profits

- Complete transparency in all compensation

- Legal fiduciary obligation to put your interests first

This alignment of interests is fundamental to building and preserving wealth. As Charlie Munger famously said, "Show me the incentives, and I'll show you the outcome." When your advisors' incentives align perfectly with your goals, the outcomes dramatically improve.

.avif)

"I've just never found somebody who, I, to be completely candid, was so honest and just has provided such a great service. And if you guys know Jim's service, he doesn't do referral fees. I've sent a ton of high seven-figure, eight-figure folks to him who have very complex problems financially and have a lot of needs, and everybody has said amazing things about their service."

Cole Gordon, CEO of Closers.IO

Unpaid client testimonial

Frequently Asked Questions

Do I need to liquidate my current investments to implement these strategies?

No. We take a methodical approach to transitioning your portfolio, carefully considering tax implications, exit fees, and market timing. Our implementation plans typically span 12-36 months to minimize disruption and optimize tax efficiency.

What types of alternative investments do you provide access to?

Our investment platform provides access to private equity, venture capital, real estate, private credit, hedge funds, managed futures, and other alternative investments—all with institutional-quality due diligence and ongoing monitoring.

How liquid are these alternative investments?

Liquidity varies by investment type. We help structure your portfolio with appropriate liquidity tiers based on your specific needs. Some alternatives have quarterly liquidity, while others might have 5-10-year lock-up periods. We ensure you maintain proper liquidity for opportunities and obligations.

What's the minimum investment required to implement these strategies?

While traditional family offices typically require $200+ million, our Fractional Family Office® approach allows entrepreneurs with 7 to 9 figures of income to access many of the same strategies and opportunities.

How do you make money if you don't charge commissions on investments?

Unlike traditional advisors who earn commissions or kickbacks, we operate on a transparent fixed-fee model based on the complexity of your situation. This aligns our interests with yours—we succeed when we provide value, not when we sell products.

How does this approach differ from what my current financial advisor offers?

Traditional advisors typically focus on allocating assets within public markets (stocks and bonds). Our approach provides access to the full spectrum of investments billionaires use, including private markets, alternative investments, and sophisticated tax strategies—all coordinated by a team that serves as your personal investment office.

Taking the Next Step

Your Path to Billionaire Investment Strategies

You've built impressive business success. Now it's time to apply that same strategic thinking to your investments. The billionaire approach to wealth management isn't just for those with billions—it's for entrepreneurs who want to protect and grow what they've worked so hard to build.

Our Fractional Family Office® provides the sophisticated investment strategies previously available only to the ultra-wealthy, delivered with complete transparency and fiduciary alignment.

If you're ready to explore how these strategies might apply to your specific situation, the next step is simple: schedule a Wealth Strategy Session. During this consultation, we'll:

Review Your

Current Investment Approach

Identify Potential Opportunities & Inefficiencies

Explain Our Systematic Investment Process

Determine if We're the Right Fit for Your Needs

There's no obligation, and you'll gain valuable insights regardless of whether we work together.

Schedule Your Wealth Strategy Session

Disclosure

Dew Wealth Management, LLC ("Dew Wealth") is an SEC-registered investment adviser located in Scottsdale, Arizona. Registration does not imply a certain level of skill or training. The information provided in this material is for general informational and educational purposes only and should not be construed as personalized investment, tax, or legal advice. All investing involves risk, including the potential loss of principal. The client testimonials featured in this material represent the views and experiences of specific clients and may not be representative of the experiences of all clients. These testimonials are unpaid and voluntary but should not be viewed as endorsements. Results will vary, and there is no guarantee that any client will achieve similar results. The clients featured may have material business or other relationships with Dew Wealth.

This material contains references to third-party figures, books, research, and media, which are provided for informational purposes only. Mentions of third parties do not imply any affiliation with or endorsement by these individuals or organizations. References to specific individuals such as Tony Robbins, Alex Hormozi, and others are for illustrative purposes only and do not imply endorsement of Dew Wealth or its services. Performance figures cited, including references to Yale's endowment returns, DALBAR studies, and other investment performance metrics, are based on historical data and are not indicative of future results. The comparison of "billionaire" investment strategies to traditional investment approaches is for illustrative purposes only and should not be interpreted as a guarantee that implementing such strategies will produce similar results. Different types of investments involve varying degrees of risk, and the future performance of any specific investment strategy cannot be guaranteed. References to alternative investments including private equity, venture capital, real estate, and other private market investments involve additional risks including limited liquidity, lack of transparency, and potential for complete loss of principal. Such investments are generally only available to qualified investors who meet specific suitability requirements.

The "Fractional Family Office®" approach described is Dew Wealth's proprietary service model and should not be understood as providing the same comprehensive services as a dedicated single-family office. The service offering, scope, and resources will differ from traditional family offices serving ultra-high-net-worth families. Tax strategies and related information are general in nature and should not be considered tax advice. Consult with a qualified tax professional regarding your specific circumstances before implementing any tax strategy. No part of this content should be construed as a recommendation to buy or sell any securities or as an offer of investment advisory services. Dew Wealth may only transact business in those states where it is registered, notice filed, or exempt from registration requirements.

For additional information about Dew Wealth, including fees and services, please request our Form ADV Part 2A disclosure brochure and Form CRS. If you have any questions regarding this content, please contact us at the phone number or address listed on our website. By accessing, using, or receiving this Document, the Recipient acknowledges and agrees to be bound by the terms and conditions outlined at DewWealth.com/IP.