The Linchpin

Partner®

Why Every Successful Entrepreneur Needs a Wealth CEO

For 7 to 9-figure entrepreneurs, business success doesn't automatically translate to personal wealth. While you excel at building companies, the complex world of wealth management requires an entirely different skillset and system. Billionaires solved this problem generations ago by employing family office CEOs to coordinate every aspect of their financial lives. But with traditional family offices costing $2 million+ annually, they've remained inaccessible to most successful entrepreneurs.

Enter the Linchpin Partner®—your dedicated wealth CEO who orchestrates every element of your financial strategy through a Fractional Family Office® model. Unlike traditional financial advisors who operate in silos with conflicting incentives, your Linchpin Partner® serves as a True Fiduciary, coordinating tax strategy, investment management, asset protection, and estate planning into a cohesive system that maximizes your after-tax wealth.

Drawing from our 25+ years of experience serving entrepreneurs exclusively, this guide reveals why successful business owners need a Linchpin Partner®, how to identify the right one, and the transformative impact they create. Discover why entrepreneurs like Cole Gordon, Pete Vargas, and Dave Asprey consider their Linchpin Partner® the most important financial decision they've made on their journey to Making Rich Real.

See If You Qualify with Our Wealth Waste Calculator

The Entrepreneur's

Wealth Management Crisis

As a successful entrepreneur, you know that what got you here won't get you there.

The very traits that made you successful in business—taking calculated risks, maintaining tight control, making quick decisions—can actually work against you when it comes to building lasting wealth. While you've mastered creating value in your business, transforming that into durable personal wealth requires an entirely different approach.

The "Financial Flat Tire"

Most Entrepreneurs Experience

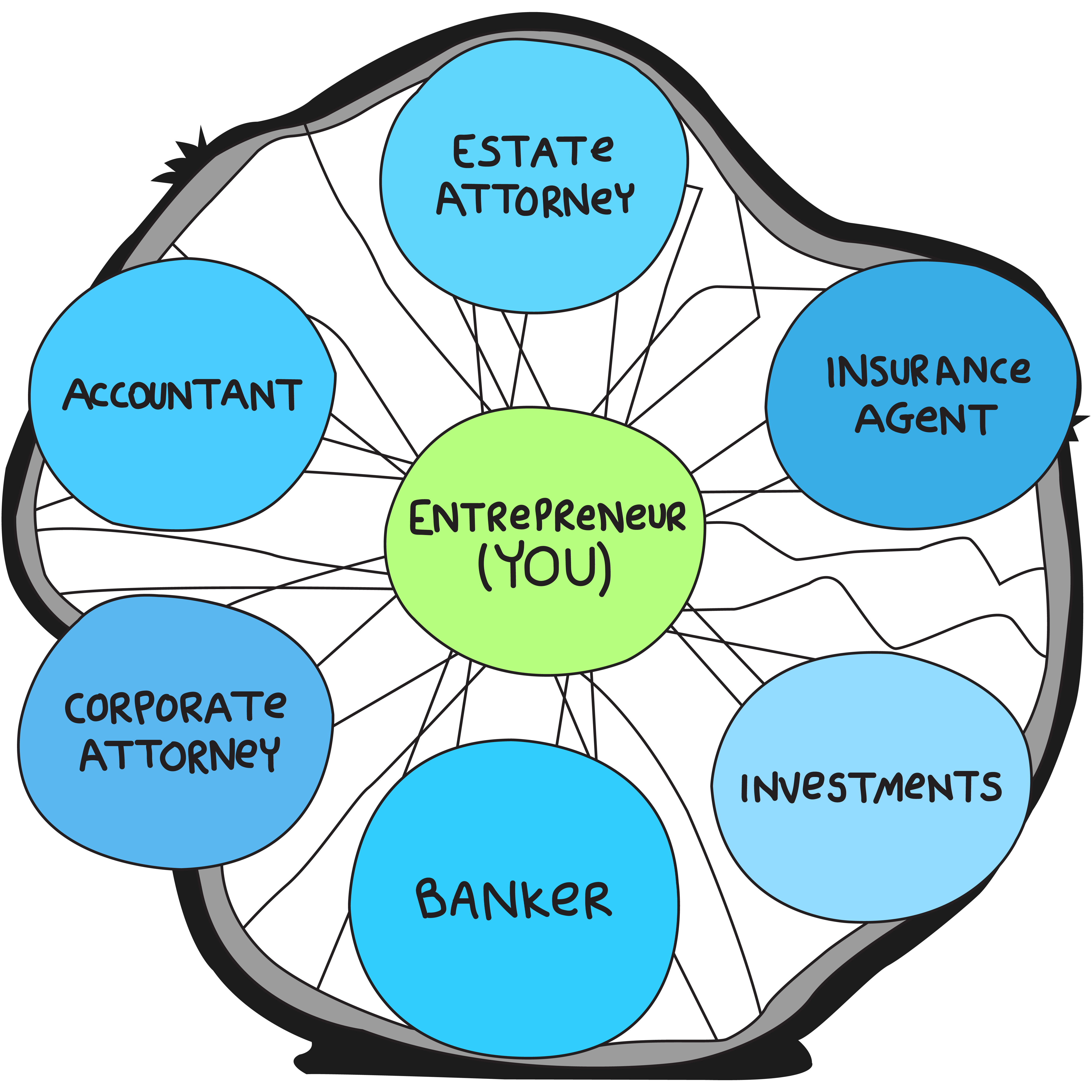

If your wealth management approach resembles most entrepreneurs, you're likely experiencing what we call the "financial flat tire." Your wealth wheel looks something like this:

- A CPA focused exclusively on tax compliance, not strategic planning

- An investment advisor pushing the same stock and bond portfolios they recommend to everyone

- An insurance agent selling products that generate the highest commissions

- An estate attorney who created documents years ago that sit in a drawer

- Maybe a handful of other specialists who never communicate with each other

"Most entrepreneurs are trapped at the center of this broken wheel, desperately trying to coordinate professionals who never talk to each other. They spend countless hours managing advisors instead of growing their business or enjoying time with family."

Jim Dew, Founder & CEO of Dew Wealth Management

Why Most Financial Advisors Fail Entrepreneurs

The traditional financial advisory model simply wasn't built for entrepreneurs. It was designed for W-2 employees with predictable incomes, simple tax situations, and minimal complexity. Your financial life couldn't be more different. The underlying problem is threefold:

Misaligned Incentives

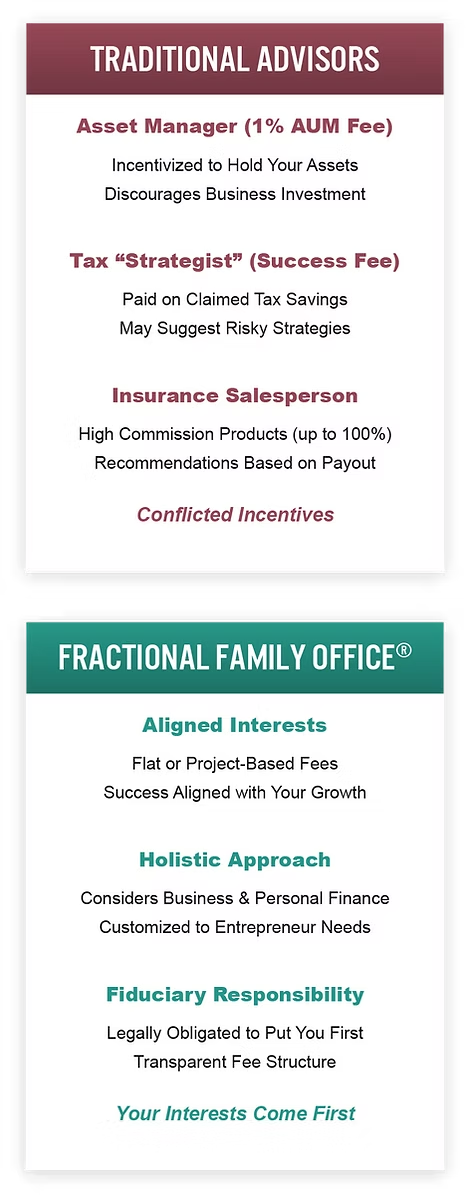

Most traditional advisors earn money in ways that directly conflict with your best interests:

The Asset Manager (1% AUM Fee): These advisors make more money when they gather and hold your assets. They're incentivized to discourage you from investing in your business (often your best opportunity) or alternative investments that they can't charge fees on.

The Tax "Strategist" (Success Fee Based): Many tax advisors earn commissions based on claimed tax savings, creating a dangerous incentive to recommend aggressive strategies that could put you at risk with the IRS later. Without fiduciary responsibility, they're not legally obligated to put your interests first.

The Insurance Salesperson (Product Commissions): These "advisors" often present themselves as wealth managers but earn massive commissions pushing expensive insurance products—sometimes receiving 100% of your first year's premium as commission. Their recommendations are driven by which products pay them the highest commissions, not what serves your needs.

Fragmented Expertise

Even well-intentioned advisors typically specialize in just one aspect of wealth management, lacking the comprehensive knowledge needed to coordinate your complete financial picture:

- Investment advisors rarely understand advanced tax strategy

- Tax professionals often know little about asset protection

- Estate attorneys frequently design plans with minimal consideration for business succession

- Insurance agents typically lack the expertise to integrate coverage with your broader wealth strategy

Reactive vs. Strategic Approach

Most advisors operate reactively rather than strategically. Instead of developing a comprehensive plan aligned with your goals, they respond to whatever questions or concerns you bring to them.

As the All-In podcast hosts have discussed on multiple episodes, the wealthiest and most successful entrepreneurs take a fundamentally different approach to managing their finances—they focus on strategic systems over tactical decisions.

The Billionaire's Secret

How the Ultra-Wealthy Solved This Problem

While most entrepreneurs struggle with fragmented advice and conflicting incentives, billionaire families solved this problem generations ago. Their solution? The family office—a dedicated team of professionals working exclusively for them, coordinated by a CEO who ensures every financial decision aligns with their long-term goals.

The Family Office Model

Billionaire family offices operate completely differently from traditional financial advisory relationships.

Single-Client Focus

The family office works exclusively for one family, eliminating conflicts of interest

Comprehensive Coordination

All aspects of wealth management are integrated—from investments and taxes to estate planning and philanthropy

True Fiduciary Alignment

With no products to sell or commissions to earn, the family office is incentivized solely to optimize the family's wealth

Proactive Strategy

Rather than reacting to market events or tax deadlines, they develop and implement sophisticated long-term plans

Specialized Expertise

They employ or contract with true experts in each area of wealth management rather than generalists

This approach has proven extraordinarily effective. According to UBS's 2024 Global Family Office Report, family offices consistently outperform traditional wealth management approaches, particularly during market volatility and economic transitions. The problem? Traditional family offices require $100-200 million in assets and cost $2 million+ annually to operate, putting them out of reach for most successful entrepreneurs.

The Birth of the Fractional Family Office®

Recognizing this gap, we pioneered the Fractional Family Office® model to bring billionaire-level wealth management to successful entrepreneurs without the massive overhead costs.

The cornerstone of this approach is the Linchpin Partner®—essentially your personal wealth CEO who develops your overall wealth strategy, assembles and coordinates your professional team, and ensures every financial decision aligns with your long-term goals. This model delivers the comprehensive, coordinated approach of a billionaire family office scaled appropriately for 7 to 9-figure entrepreneurs.

Discover Your Potential Wealth Savings with Our Wealth Waste Calculator

"I had never seen a model for advisory in the way that they ran it. I have a peace of mind around my finances, my insurance, my assets protection, my taxes and all of that stuff because they're constantly working on my behalf."

Pete Vargas, Entrepreneur

Unpaid client testimonial

What is a Linchpin Partner®?

Your Linchpin Partner® serves as the CEO of your financial life, operating at the center of your wealth management system to ensure everything works in harmony. Think of them as your personal Chief Financial Strategist—a trusted advisor who understands both your business and personal financial lives and ensures they work together seamlessly.

Unlike traditional financial advisors who focus on selling products or gathering assets to manage, a Linchpin Partner® takes a fundamentally different approach.

Non-Negotiable Criteria

At Dew Wealth, our team of Linchpin Partner® advisors must meet three essential criteria that set them apart from traditional advisors:

True Fiduciary Responsibility

A True Fiduciary is legally and ethically bound to put your interests ahead of their own. This goes beyond the limited "suitable" many advisors claim when recommending investments.

Our Linchpin Partner® advisors operate as fiduciaries across all aspects of your financial life—investments, insurance, tax planning, entity structure, estate design, and more. We accept no commissions, no referral fees, and no kickbacks from any products or professionals we recommend.

"I've sent a ton of high seven-figure, eight-figure folks to him who have very complex problems financially, and I was telling him the other day, everybody has said amazing things about their service. And not just Jim is amazing, but also his account managers."

—Cole Gordon, CEO of Closers.IO

Unpaid client testimonial

Specialized Experience with Entrepreneurs

Generic financial advice doesn't work for entrepreneurs. You need someone who understands the unique challenges and opportunities you face.

We have 26 years of experience working with business owners and entrepreneurs. We understand the intersection of business and personal finance, the complexity of business transitions, and the tax challenges unique to entrepreneurs.

Unlike traditional advisors who might have a handful of business owner clients among hundreds of others, we work exclusively with entrepreneurs—giving us unmatched insight into the strategies that actually work for people like you.

Expert Knowledge Across Financial Disciplines

Most financial professionals specialize in one area: investments, taxes, insurance, or estate planning. This specialization creates the silos that plague traditional wealth management.

A true Linchpin Partner® must have expert-level knowledge across all these disciplines to effectively coordinate them. They don't need to be the deepest technical expert in every area—that's what specialist team members are for—but they need sufficient expertise to ensure all the pieces work together.

.avif)

—Dave Asprey, founder of Bulletproof who has generated over $500 million in revenue.

Unpaid client testimonial

The Wealth Wheel Metaphor

From Broken to Functional

The Linchpin Partner® transforms your "financial flat tire" into a smoothly running Wealth Wheel by:

Evaluating Your Current Team

Assessing the strengths and weaknesses of your existing advisors

Upgrading Underperformers

Replacing subpar professionals with A-players from our network of over 500 vetted specialists

Ensuring Team Collaboration

Creating systems for regular communication and coordination among all your advisors

Monitoring Ongoing Performance

Providing accountability through regular reviews and benchmarking

Managing the Complex

Whole

Ensuring nothing falls through the cracks in your wealth management system

As your Linchpin Partner® takes over the coordination role, you shift from being trapped at the center of a broken wheel to becoming the driver of a finely-tuned wealth vehicle.

Calculate How Much Your Current Approach Is Costing You with Our Wealth Waste Calculator

"I was originally just looking for somebody to help me out with my wealth management, financial planning and to help do some tax savings; but they've been way more than that," "Unbelievable to work with. Super, super high integrity. Fast turnaround, really professional, great detail, easy to work with."

Cameron Herold, Founder of the CEO Alliance

Unpaid client testimonial

The Transformative Impact

of a Linchpin Partner®

Working with a Linchpin Partner® fundamentally transforms how you manage your wealth. Here's what changes:

From Reactive to Proactive

Instead of scrambling to respond to tax deadlines, market changes, or business opportunities, your Linchpin Partner® helps you develop comprehensive strategies that anticipate and prepare for these events.

"They pay attention to little details that other people miss. They've made my team happier, and they've made my life a lot easier."

Lee Richter, Chief Visionary Officer & CEO of Global Leaders Collective

Unpaid client testimonial

From Fragmented to Integrated

Rather than having disconnected advisors making recommendations in isolation, your Linchpin Partner® ensures every aspect of your wealth strategy works in concert. This integration eliminates the gaps, conflicts, and inefficiencies that plague traditional approaches.

.avif)

"I spend my time doing what I love, and I am good at. My team does what they are good at. And we know that there's someone managing all the other stuff that I don't want to spend time doing. They have completely removed all financial stress from my life."

Mike Arce, Founder of Loud Rumor

Unpaid client testimonial

From Time-Consuming to Time-Saving

Perhaps the most immediate benefit entrepreneurs experience is reclaiming their time. Instead of spending hours coordinating advisors and trying to make sense of complex financial recommendations, you have a single point of contact managing everything.

"Adding them to my team has easily been one of the best decisions that I've ever made, bar none in business. They've helped me actually maximize my investments."

Keala Kanae, Founder & CEO of Fullstaq Marketer

Unpaid client testimonial

From Opportunity Cost to Opportunity Capture

With a Linchpin Partner® managing your wealth strategy, you gain access to opportunities typically reserved for the ultra-wealthy:

- Advanced tax strategies that can save six or seven figures annually

- Alternative investments beyond traditional stocks and bonds

- Sophisticated asset protection structures that shield your wealth

- Coordinated estate and business succession planning

These strategies create compounding benefits that dramatically accelerate your wealth building over time.

Finding Your Perfect Linchpin Partner®

Not every Linchpin Partner® is created equal. The right partner for you should meet these essential criteria:

Fiduciary at All Times

Ensure your Linchpin Partner® is a fiduciary 100% of the time—not just when managing investments. Ask these revealing questions:

-

"How are you compensated? Do you receive any commissions, referral fees, or kickbacks from recommended products or professionals?"

-

"Are you legally bound to put my interests first in all aspects of our relationship?"

-

"Can you provide a written fiduciary oath that covers all aspects of our engagement?"

The right answer is complete transparency with no hidden compensation that could create conflicts of interest.

Entrepreneur-Specific Experience

Your Linchpin Partner® should have deep experience with entrepreneurs specifically, not just general financial planning credentials. Ask:

-

"What percentage of your clients are entrepreneurs or business owners?"

-

"How many years have you been working specifically with entrepreneurs?"

-

"Can you provide examples of how you've helped entrepreneurs in situations similar to mine?"

Look for someone who works exclusively or primarily with entrepreneurs and has done so for at least a decade.

Comprehensive Knowledge

Your Linchpin Partner® needs sufficient expertise across multiple financial disciplines to effectively coordinate specialists. Ask:

-

"How do you stay current on tax law, investment strategies, asset protection, and estate planning?"

-

"Can you explain how these different areas of wealth management interact with each other?"

-

"How do you coordinate specialists to ensure they're working together effectively?"

The right partner should demonstrate comfort discussing all these areas while knowing when to bring in deeper specialists.

Cultural & Personal Fit

Beyond technical qualifications, the relationship with your Linchpin Partner® is deeply personal. You'll be sharing intimate details about your finances, family, and aspirations. Ask yourself:

-

"Do I trust this person with sensitive information about my wealth?"

-

"Do they understand my values and priorities beyond just the numbers?"

-

"Would I enjoy working with them over the long term?"

Systematic Approach

Finally, your Linchpin Partner® should have clear systems and processes for managing your wealth rather than an ad-hoc approach. Ask:

-

"What system do you use to ensure nothing falls through the cracks in my wealth management?"

-

"How do you monitor and evaluate my professional team's performance?"

-

"What regular review processes do you have in place?"

Look for structured approaches to every aspect of wealth management rather than reactive, seat-of-the-pants methods.

"What we've enjoyed about working with Dew Wealth is primarily the human side that they bring to the business that can be so complicated. They truly care about our well-being."

Claudia Zanes, Co-Founder of Zanes Law

Unpaid client testimonial

The Systematic Onboarding Process

At Dew Wealth, we've refined our Linchpin Partner® onboarding process over 26 years to ensure nothing gets missed. Here's how we transform your wealth management approach:

P H A S E O N E

Comprehensive

Discovery

We begin with a deep dive into your current financial situation, examining your:

Business structure, operations, & future plans

Personal assets, liabilities, & cash flow

Existing professional team & their performance

Tax returns for the past two years

Current insurance coverage & estate documents

Investment portfolio & strategy

Long-term goals & priorities

This thorough analysis allows us to identify gaps, inefficiencies, & opportunities in your current approach.

P H A S E T W O

Strategic

Development

Based on our discovery findings, we develop a comprehensive wealth strategy that addresses:

Tax optimization across business and personal finances

Investment allocation based on the "billionaire model"

Risk management and asset protection

Estate and legacy planning

Business succession and exit strategies

We present this strategy in clear, actionable terms, explaining not just what we recommend but why.

P H A S E T H R E E

Implementation

With your strategy approved, we coordinate implementation across your entire wealth team:

Managing communication with existing advisors

Bringing in specialist expertise where needed

Overseeing documentation and execution

Ensuring all elements are properly integrated

Providing regular progress updates

This phase typically takes 90-360 days depending on the complexity of your situation.

P H A S E F O U R

Ongoing

Management

Once your initial strategy is implemented, we provide continuous oversight & optimization:

Regular strategy reviews (typically quarterly)

Proactive identification of new opportunities

Adjustments based on changing laws, markets, and personal circumstances

Coordination of your professional team through regular communication

Annual comprehensive strategy refinement

This approach ensures your wealth management operates with the same level of professionalism & strategic thinking that you apply to your business.

Frequently Asked Questions

What distinguishes a Linchpin Partner® from other financial advisors?

A Linchpin Partner® differs from traditional advisors in several key ways. First, they serve as a True Fiduciary in all aspects of your financial life, not just investments. Second, they focus specifically on entrepreneurs rather than general financial planning. Third, they coordinate all aspects of your wealth management—taxes, investments, estate planning, business strategy—rather than operating in silos. Finally, they're compensated through transparent fees rather than commissions or asset-based charges, aligning their incentives directly with your interests.

How is your fee structure different from traditional wealth managers?

Unlike traditional advisors who charge based on assets under management (typically 1%) or earn commissions from products they sell, we operate on a transparent, fixed-fee basis. This aligns our interests with yours and ensures we remain focused on optimizing your entire wealth strategy, not just gathering assets or selling products. Our fees are based on the complexity of your situation rather than the size of your investment portfolio, allowing us to recommend whatever strategies best serve your needs without conflicts of interest.

Do I need to replace my current advisors to work with a Linchpin Partner®?

Not necessarily. We evaluate your existing team based on performance and fit, often continuing to work with qualified professionals who are serving you well. Where we identify gaps or underperformance, we can recommend specialists from our network of over 500 vetted professionals. Either way, your Linchpin Partner® serves as the quarterback of your wealth team, ensuring everyone works together effectively toward your goals.

What types of entrepreneurs do you typically work with?

We specialize in serving 7 to 9-figure entrepreneurs across various industries. Our clients typically have complex financial situations involving business ownership, significant income, and substantial assets. They're looking for sophisticated strategies beyond what traditional advisors offer but don't yet have the scale for a traditional family office. Most importantly, they value having a dedicated partner who takes ownership of their wealth management so they can focus on their business and family.

How is this different from having a CFO in my business?

A business CFO focuses specifically on your company's finances—budgeting, financial reporting, cash flow management, etc. Your Linchpin Partner®, by contrast, focuses on your complete wealth picture—coordinating both business and personal finances to maximize your overall wealth. They ensure your business strategy aligns with your personal financial goals and manage the complex intersection between the two, which most business CFOs aren't equipped to handle.

What if I already have an investment advisor I'm happy with?

That's not uncommon. Many of our clients come to us with existing investment relationships they wish to maintain. We can work alongside your current investment advisor, providing coordination and strategic guidance while they continue managing your portfolio. Over time, we often find opportunities to optimize these relationships or suggest complementary strategies your advisor may not offer.

Calculate How Much Your Current Approach Is Costing You with Our Wealth Waste Calculator

"They have been a tremendous help. They were able to put in tax strategies to save me hundreds of thousands of dollars. They've also been able to reduce the fees for some of my financial advisors that will also save me hundreds of thousands of dollars per year."

Joel Marion, Co-Founder of BioTrust Nutrition

Unpaid client testimonial

Making Rich Real Through Partnership

For successful entrepreneurs, the journey from business success to lasting wealth isn't automatic. It requires the same level of strategic thinking, systematic processes, and expert guidance that built your business in the first place.

The Linchpin Partner® model represents a fundamental reimagining of wealth management for entrepreneurs—bringing billionaire-level strategies and coordination to 7 to 9-figure business owners through the Fractional Family Office® approach. Your business deserves a strategic approach to wealth management that matches its sophistication and complexity. Your Linchpin Partner® serves as the CEO of that process, coordinating every aspect of your financial life to help you Make Rich Real®.

Ready to explore how a Linchpin Partner® could transform your approach to wealth management? Take the first step by calculating your potential savings through our Wealth Waste Calculator

Disclosure

Dew Wealth Management, LLC ("Dew Wealth") is an SEC-registered investment adviser located in Scottsdale, Arizona. Registration does not imply a certain level of skill or training. The information provided in this material is for general informational and educational purposes only and should not be construed as personalized investment, tax, or legal advice. All investing involves risk, including the potential loss of principal.

This material contains the opinions of Dew Wealth, and such opinions are subject to change without notice. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy, or investment product. Client testimonials may not be representative of the experience of other clients and are not indicative of future performance or success. The individuals providing testimonials were not compensated for their statements. Results depicted in client testimonials may vary from client to client based on their specific circumstances, and there are no guarantees that any client will achieve similar results. Testimonials were provided by current clients of Dew Wealth.

References to "Advanced tax strategies," "billionaire models," "family office approaches," and other similar terms are general descriptions and are not guarantees of specific outcomes. Tax strategies that may be appropriate for one individual may not be appropriate for another, and all strategies are subject to changes in tax laws and regulations. Dew Wealth is not a law firm or accounting firm, and no portion of this content should be interpreted as legal, accounting, or tax advice. Alternative investments mentioned in this material involve higher fees, limited liquidity, and may lack transparency compared to traditional investments. They may not be suitable for all investors and could involve a high degree of risk. Past performance is not indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product will be profitable or equal any historical performance levels.

Fractional Family Office® and Wealth Waste Calculator® are registered trademarks of Dew Wealth Management, LLC. The term "Making Rich Real™" is also a registered trademark of Dew Wealth Management, LLC. Dew Wealth may only transact business in those states in which it is notice-filed or qualifies for an exemption or exclusion from notice-filing requirements. For information regarding the registration status of Dew Wealth and its professionals, please see the SEC's Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov. For full details about our services, fees, and other important information, please review our Form ADV Part 2A, which is available on the SEC's website or by request from our office. Our Relationship Summary (Form CRS) is also available on request.

By accessing, using, or receiving this Document, the Recipient acknowledges and agrees to be bound by the terms and conditions outlined at DewWealth.com/IP.