Strategic

Tax Planning

How Billionaires Legally Minimize Their Taxes

(And How Entrepreneurs Can Too)

Entrepreneur Tax Planning

For successful entrepreneurs, taxes represent their single largest expense—yet most rely on reactive tax preparation rather than proactive tax strategy. While the average business owner focuses on growing revenue, billionaires understand that keeping what you make is equally important. They've solved this problem by employing sophisticated family offices with dedicated tax strategists who proactively identify and implement tax-saving opportunities year-round.

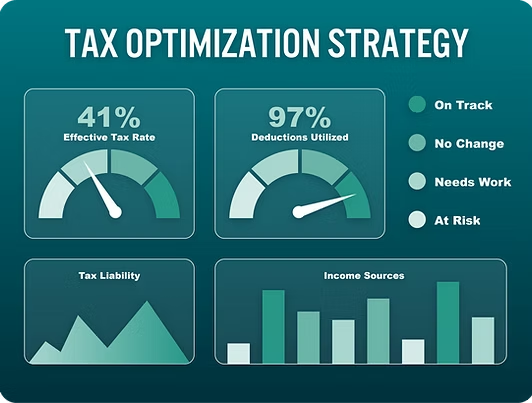

This comprehensive guide reveals the systematic approach billionaires use to minimize their tax burden and how our Fractional Family Office® brings these same strategies to 7-9 figure entrepreneurs. Based on data from hundreds of entrepreneur clients, our systematic tax planning process has generated significant tax savings, with a statistical average of $203,769 from 2024’s projections.

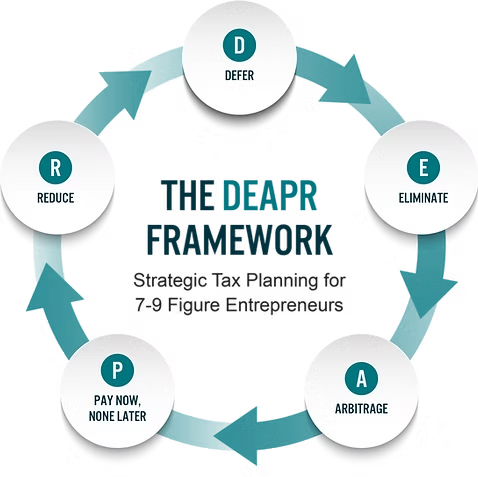

While individual results vary considerably based on specific circumstances, this page outlines the proven DEAPR framework and systematic process we use to help entrepreneurs keep more of what they've earned.

The Million-Dollar Problem

Most Entrepreneurs Don't Know They Have

As Jim Dew discovered when he first crossed the seven-figure income threshold, there's a profound difference between making money and keeping it. Looking at his tax return, he realized he had just "bought the government a house" with his tax payment —and a really nice house at that. This experience mirrors what we see with entrepreneurs every day. They excel at building businesses that generate impressive revenue, but when it comes to strategic tax planning, they're leaving hundreds of thousands—sometimes millions—on the table. Warren Buffett famously said, "The first rule of investment is don't lose money. And the second rule of investment is don't forget the first rule."

This wisdom applies perfectly to tax planning—while entrepreneurs focus intensely on growing revenue, they often overlook the importance of keeping what they earn. The root problem? Most entrepreneurs work with tax historians instead of tax strategists. This critical distinction costs them significantly year after year.

Tax Historians

Most CPAs

Focus on compliance and reporting past events

Meet with you primarily during tax season

Document what has already happened

Reactive approach to tax obligations

Result: You pay what the standard tax code dictates

Tax Strategists

The Billionaire Approach

Focus on proactively planning to minimize future tax burdens

Engage in year-round tax planning and strategy sessions

Architect what will happen through strategic planning

Proactive approach to tax optimization

Result: You pay the least allowed legally within the confines of the tax code

Think about it: Would you run your business by only looking in the rearview mirror? Of course not. Yet that's exactly how most entrepreneurs approach tax planning.

What Billionaires Do Differently

Billionaires solved this problem decades ago by building family offices that employ full-time tax strategists who proactively plan and coordinate tax-saving opportunities year-round. Oprah Winfrey, Jeff Bezos, and Elon Musk don't wait until April to think about taxes. They have dedicated teams continuously identifying and implementing strategies to minimize tax burdens legally and ethically. As Mark Cuban stated in an interview with Business Insider, "It's not about how much you make, but how much you keep."

This concise wisdom underscores why the ultra-wealthy prioritize tax planning as much as revenue generation. While this approach is incredibly effective, traditional family offices typically require $200+ million in assets and cost millions annually to operate—making them inaccessible to most successful entrepreneurs. That's why we created something different: A Fractional Family Office® that brings billionaire-level tax planning to successful entrepreneurs at a fraction of the cost.

Calculate Your Potential Tax Savings with Our Wealth Waste Calculator

The Systematic Approach That Drives Results

Our systematic tax planning process has helped entrepreneurs save between $0 and $904,313. As mentioned, our average client saved approximately $203,769 in projected taxes based on 2024 data. While every situation is unique and results vary significantly based on individual income and circumstances, our data shows typical entrepreneurs see a 4x to 12x return on their investment.

How do we achieve these results? Through a systematic four-phase process that transforms reactive tax compliance into proactive tax strategy:

Phase 1: Deep Historical Analysis

We begin by analyzing past tax returns to uncover missed opportunities and savings potential:

- Comprehensive review of past 2 years of tax returns (personal and business)

- Identification of missed opportunities

- Analysis of current tax burden across all entities and jurisdictions

- Documentation of specific potential savings areas with projected impact

- Detailed tax situation benchmarking against similar businesses

During this phase, we often find entrepreneurs have been missing key strategies for years. Sometimes clients have basic errors that we can even amend the tax returns to capture. Meaning immediate refunds from the IRS.

Phase 2: Strategic Development Using the DEAPR Framework

We leverage our proprietary DEAPR Framework to create a customized tax strategy that optimizes every aspect of your tax situation. DEAPR stands for:

- Defer: Make Uncle Sam Wait

- Eliminate: Make Taxes Disappear (Legally)

- Arbitrage: Play Different Tax Rates Against Each Other

- Pay Now, None Later: Front-Load Tax for Future Freedom

- Reduce: Maximize Deductions and Credits

Defer: Make Uncle Sam Wait

Tax deferral follows a simple principle: a dollar in your pocket today is worth more than a dollar in your pocket tomorrow. When you defer taxes, you're not just saving on today's tax bill—you're allowing your money to compound without the drag of taxation. Key strategies include:

Retirement Accounts Optimization

401(k) Plans: These qualified retirement plans allow entrepreneurs to contribute up to $24,500 per year (2025), plus employer contributions up to 25% of compensation, with a total potential annual contribution of $73,500. For business owners over 50, an additional $7,500 catch-up contribution is available. The tax benefit is immediate—every dollar contributed reduces your taxable income for the current year.

SEP IRAs: Simplified Employee Pension IRAs permit contributions of up to 25% of your income, with a maximum of $70,000 (2025). For entrepreneurs with significant income but simpler business structures, SEPs offer higher contribution limits than traditional IRAs with less administrative complexity than 401(k) plans.

Cash Balance Plans: These defined benefit plans allow much larger contributions than 401(k)s or SEP IRAs—potentially exceeding $300,000 annually for older business owners. Cash balance plans work particularly well for established businesses with consistent profits and owners approaching retirement age who need to accelerate retirement savings.

Advanced Deferral Strategies

These Real Estate Depreciation & Cost Segregation: Rather than depreciating real estate investments over 27.5 years (residential) or 39 years (commercial), cost segregation studies identify components that can be depreciated over shorter periods (5, 7, or 15 years). This accelerates depreciation deductions, potentially creating significant tax savings in the early years of ownership. For a $2 million commercial property, a cost segregation study might identify $600,000 in components eligible for accelerated depreciation, generating over $200,000 in tax savings in the first five years of ownership.

Qualified Real Estate Professional Status (QREPS): For entrepreneurs actively involved in real estate, qualifying as a real estate professional allows passive rental losses to offset active income from other sources. To qualify, you must spend at least 750 hours annually in real estate activities, and more than half your total working time must be devoted to real estate. This status can transform paper losses from depreciation into powerful tax shields against ordinary income.

Installment Sales: When selling appreciated property or businesses, installment sales spread the gain over multiple tax years rather than triggering all at once. For a business sale of $5 million with a $4 million gain, an installment sale over five years could keep the seller in lower tax brackets each year, potentially saving tens of thousands in taxes.

Opportunity Zone Investments: Investing capital gains into Qualified Opportunity Zones allows you to defer those gains until December 31, 2026, with a 10% reduction if held for 5+ years. Additionally, if the Opportunity Zone investment is held for 10+ years, any new appreciation becomes completely tax-free. This offers triple tax benefits: deferral, reduction, and elimination of different portions of the gain.

1031 Exchanges: These allow real estate investors to defer capital gains taxes indefinitely by exchanging investment properties for "like-kind" properties. For a property that has appreciated from $1 million to $3 million, a 1031 exchange could defer $400,000+ in combined federal and state taxes, allowing that capital to continue working in the replacement property instead of going to the IRS.

Eliminate: Make Taxes Disappear (Legally)

While deferral is powerful, elimination is the holy grail of tax planning. These strategies can permanently remove tax liability—not just postpone it. Key elimination strategies include:

S-Corporation Reasonable Compensation Strategy

This approach optimizes the division between salary and distributions for S-Corporation owners. While all business profits flow through to your personal tax return, only the salary portion is subject to self-employment (FICA) taxes of 15.3%.

The key is setting a "reasonable" salary for the work you perform while taking remaining profits as distributions exempt from FICA taxes. For example, if your business nets $500,000 and you pay yourself a reasonable salary of $150,000, you'd save approximately $53,550 in self-employment taxes compared to operating as a sole proprietor or single-member LLC.

The IRS scrutinizes these arrangements, so proper documentation of salary reasonableness through industry comparisons and job descriptions is essential.

Gift Appreciated Stock

When you own stocks that have significantly appreciated, donating them directly to qualified organizations creates a double tax benefit. You avoid capital gains tax on the appreciation while receiving a charitable deduction for the full fair market value.

For instance, if you own stock purchased for $20,000 that's now worth $100,000, donating it directly to charity rather than selling it first would save approximately $19,000 in capital gains taxes (assuming a 23.8% rate including Net Investment Income Tax).

Plus, you'd receive a $100,000 tax deduction, potentially saving an additional $37,000 in income taxes (at the 37% rate), for total tax savings around $56,000.

Pass-Through Entity Tax (PTET)

This strategy works primarily for entrepreneurs in high-tax states like California, New York, or New Jersey. Established in response to the $10,000 SALT deduction limitation from the 2017 Tax Cuts and Jobs Act, PTET allows pass-through businesses to pay state income tax at the entity level rather than passing it through to individual returns.

For a California entrepreneur with $1 million in business income, approximately $123,000 in state taxes would normally be subject to the $10,000 SALT limitation.

With PTET, the entire amount becomes deductible at the entity level, potentially saving around $42,000 in federal taxes. Over 30 states now offer some version of this workaround.

Tax-Free Exchange Strategies

Qualified Small Business Stock (QSBS): Section 1202 of the tax code allows for 100% exclusion of capital gains from qualifying C-Corporation stock held for more than 5 years, up to the greater of $10 million or 10x your initial investment.

For entrepreneurs who structure their businesses as C-Corporations from inception, this can create enormous tax savings upon exit. A founder who invested $1 million in their C-Corporation could potentially exclude $10 million in gains from taxation upon sale, saving over $2.3 million in federal taxes.

Primary Residence Exclusion: Section 121 allows homeowners to exclude up to $500,000 in capital gains ($250,000 if single) from the sale of their primary residence if they've lived there for at least two of the past five years. This exclusion can be used repeatedly throughout your lifetime, allowing strategic "house-hacking" by upgrading homes every few years and capturing tax-free appreciation.

The 280A/Augusta Rule

Named after Augusta, Georgia (home of the Masters golf tournament), Section 280A allows you to rent your personal residence to your business for up to 14 days per year without reporting the rental income on your personal tax return. Businesses can deduct these legitimate business expenses, creating a tax-free transfer from your business to you.

For instance, holding quarterly board meetings or annual strategic planning sessions at your home can generate $3,000-$10,000 per day in legitimate, tax-free income.

Documentation requirements include establishing fair market rental rates, maintaining meeting minutes, and having genuine business purposes for the rentals.

Family Income Shifting Strategies

Paying Children: If your children perform legitimate work in your business, you can pay them reasonable wages that generate business deductions while shifting income to their lower tax brackets.

Children under 18 working in a family business that's not a corporation are exempt from FICA taxes, and they can earn up to the standard deduction ($15,000 in 2025) completely tax-free.

Additionally, children can contribute earned income to Roth IRAs, allowing tax-free growth for decades. A 16-year-old who contributes $7,000 annually to a Roth IRA for three years ($21,000 total) could have over $600,000 by age 65, assuming 8% average annual returns—all completely tax-free.

Arbitrage: Play Different Tax Rates Against Each Other

Tax arbitrage involves leveraging differences in tax rates across time periods, entities, income types, or family members to reduce your overall tax burden. This sophisticated approach exploits legitimate rate disparities built into the tax code. Key arbitrage strategies include:

Entity Arbitrage

C-Corporation vs. Pass-Through Strategy: The 2017 Tax Cuts and Jobs Act created a 21% flat corporate tax rate, substantially lower than the top individual rate of 37%. This creates arbitrage opportunities for entrepreneurs who can strategically use C-Corporations to accumulate earnings at the lower corporate rate. For businesses reinvesting profits for growth rather than distributing to owners, the C-Corporation structure can result in significant tax savings. The key is balancing corporate accumulation with eventual distribution planning to minimize the double taxation impact when funds are finally withdrawn.

Multiple Entity Structures: Using combinations of entities—S-Corporations, C-Corporations, partnerships, and trusts—creates powerful arbitrage opportunities by directing different income streams to the most tax-advantaged entity. For example, intellectual property might be held in one entity and leased to operating businesses, or real estate might be separated from business operations. A medical practice doing $3 million in revenue might operate as an S-Corporation while placing its building in a separate LLC. The S-Corporation pays market-rate rent to the LLC, generating business deductions while moving income to an entity potentially eligible for qualified business income deductions or passive activity treatment.

IC-DISC: International Tax Arbitrage

The Interest-Charge Domestic International Sales Corporation (IC-DISC) creates tax arbitrage for businesses with export sales. Companies establish a separate IC-DISC entity that receives "commissions" on qualified export sales, typically calculated as the greater of 50% of net export income or 4% of gross export receipts.

The operating business deducts these commissions at ordinary income tax rates (up to 37%), while distributions from the IC-DISC to shareholders are taxed at qualified dividend rates (typically 20% plus 3.8% NIIT).

This creates a tax rate arbitrage of approximately 13.2%. For a business with $5 million in qualified export sales, an IC-DISC could generate tax savings between $130,000 and $330,000 annually. This strategy requires minimal operational changes and administrative costs typically range from $5,000 to $15,000 annually.

Private Insurance Companies

Also known as captive insurance companies, these entities allow businesses to create their own insurance company to cover risks that commercial carriers won't insure or charge excessive premiums for.

The business pays premiums to its captive (deductible at ordinary income rates), while the captive can elect under Section 831(b) to exclude underwriting profits from taxation.

For qualifying small insurance companies (receiving premiums under $2.65 million annually in 2025), this creates tax arbitrage between the business's ordinary income tax rate and the captive's preferential treatment. For example, if a business pays $1 million in premiums to its captive and experiences $50,000 in actual claims, the $950,000 in underwriting profit can potentially grow tax advantaged. This strategy requires significant compliance with insurance regulations, including risk distribution and legitimate insurance operations.

ESOP: Labor-Capital Arbitrage

An Employee Stock Ownership Plan (ESOP) creates powerful tax arbitrage opportunities for business owners approaching exit. When selling to an ESOP, owners can defer capital gains taxes indefinitely by reinvesting the proceeds into qualified replacement property (typically publicly traded securities) through a Section 1042 rollover.

Additionally, the portion of the company owned by the ESOP becomes tax-exempt—an S-Corporation that's 100% ESOP-owned pays zero federal income tax. This tax-exempt status creates a competitive advantage as the business effectively operates tax-free.

For a business worth $10 million with a $9 million gain, an ESOP transaction could defer over $2 million in capital gains taxes while simultaneously creating a tax-exempt entity going forward. This strategy works particularly well for businesses with strong cash flow, a stable workforce, and owners who care about preserving company legacy.

Income Type Arbitrage

Long-term vs. Short-term Capital Gains: The differential between short-term capital gains (taxed as ordinary income up to 37%) and long-term capital gains (taxed at 0%, 15%, or 20%) creates obvious arbitrage opportunities. Simply holding investments for at least one year and a day can reduce your tax rate by nearly half. For an investment that has appreciated from $100,000 to $200,000, the tax difference between selling just before or just after the one-year mark could exceed $20,000. Strategic tax-loss harvesting and timing of gains recognition can further enhance this arbitrage.

Geographic Arbitrage

The tax rate difference between high-tax states like California (13.3% top rate) and no-income-tax states like Florida, Texas, Nevada, or Wyoming creates enormous arbitrage opportunities. For entrepreneurs with flexibility in where they live, establishing residency in a tax-friendly state can save millions over your lifetime. A business owner earning $2 million annually who moves from California to Nevada could save approximately $266,000 in state income taxes each year. Over 10 years, that's $2.66 million in direct tax savings, not counting the investment growth on that preserved capital.

Pay Now, None Later: Front-Loading Tax for Future Freedom

Sometimes the smartest tax move isn't to minimize your current tax bill—it's to pay taxes strategically now to eliminate them completely in the future. This approach requires long-term thinking and disciplined planning. Key "Pay Now, None Later" strategies include:

Roth Conversion Strategies

Traditional to Roth Conversions: Converting traditional IRA or 401(k) assets to Roth accounts requires paying taxes now on the converted amount, but all future growth and withdrawals will be completely tax-free. This strategy is particularly powerful during temporary income dips, business losses, or when you believe tax rates will increase in the future.

For instance, if you convert $500,000 from a traditional IRA to a Roth IRA during a year when your other income is relatively low, you might pay $150,000 in taxes on the conversion. But if that $500,000 grows to $2 million over 20 years, all $1.5 million in growth becomes completely tax-free—potentially saving hundreds of thousands in future taxes.

Mega Backdoor Roth: For 2025, this advanced strategy allows contributions up to $46,500 in after-tax dollars to your 401(k), then immediate conversion to a Roth account. While technically complex, this creates enormous tax-free growth potential for high-income entrepreneurs whose direct Roth IRA contributions would otherwise be limited.

Self-Directed Roth IRAs

These specialized retirement accounts allow you to invest in alternative assets with explosive growth potential within a tax-free wrapper. Unlike conventional Roth IRAs limited to traditional investments, self-directed Roth IRAs can hold:

Private Equity & Venture Capital: Early-stage investments that might deliver 10x or 100x returns.

Real Estate Investments: Direct properties, syndications, or private lending.

Private Lending: Notes, trust deeds, or direct loans to businesses.

Cryptocurrency: Digital assets with significant appreciation potential precious metals: Physical gold, silver, platinum, and palladium.

The power of this strategy is magnified by the asymmetric return potential of alternative investments. For example, an entrepreneur could use his self-directed Roth IRA to invest $50,000 in a startup. The company was acquired five years later, turning that investment into $1.2 million—all completely tax-free.

Tax-Advantaged Education Funding

529 Plans: Contributions are made with after-tax dollars, but all growth and qualified withdrawals for education expenses are completely tax-free. Many states offer additional state income tax deductions for contributions, creating immediate tax benefits as well.

For a family saving $15,000 annually for a child's education starting at birth, the account could grow to over $480,000 by age 18 (assuming 8% annual returns). Without the 529 plan, taxes on the growth would reduce this amount by $70,000 or more.

529 to Roth IRA Rollovers: Under the SECURE 2.0 Act, unused 529 plan funds can now be rolled over into a Roth IRA for the beneficiary, up to a $35,000 lifetime cap. This creates powerful flexibility for education savings that might not be fully utilized, allowing the beneficiary to begin retirement savings with already tax-advantaged funds.

Reduce: Maximize Deductions & Credits

Reduction strategies focus on decreasing your taxable income through deductions, exclusions, and credits—areas where most entrepreneurs leave significant money on the table. Key reduction strategies include:

Contributions Section 199A: The Entrepreneur's "20% off" Coupon

The Section 199A Qualified Business Income (QBI) deduction allows pass-through business owners to deduct up to 20% of their qualified business income. For entrepreneurs with taxable income below $197,300 (single) and $394,600 (Married) for 2025, this deduction applies to most business types with few limitations.

On $500,000 of qualified business income, this deduction could reduce your taxable income by $100,000, saving approximately $37,000 in federal taxes at the highest bracket.

For entrepreneurs above the income thresholds, especially in specified service businesses, strategic planning becomes essential to maximize this deduction through entity structuring, timing income recognition, and retirement plan contributions.

Business Expense Optimization

Home Office Deduction: For 2025, you can deduct up to $1,500 using the simplified method ($5 per square foot up to 300 square feet) or potentially much more using the actual expense method, which allocates a portion of mortgage interest, property taxes, utilities, repairs, and depreciation based on the percentage of your home used exclusively for business.

Vehicle Deductions: Strategic documentation and planning can maximize vehicle-related deductions, whether using the standard mileage rate ($0.70/mile projected for 2025) or the actual expenses method. For high-mileage business drivers, proper tracking can generate deductions exceeding $30,000 annually.

Travel, Meals, & Entertainment: With proper documentation and business purpose, you can deduct 50% of business meals, 100% of travel expenses, and certain entertainment costs when structured appropriately. Entrepreneurs frequently underutilize these deductions due to inadequate recordkeeping.

Asset-Based Deductions

Section 179 Expensing: This allows businesses to deduct the full purchase price of qualifying equipment and software in the year it's purchased, rather than depreciating it over time. For 2025, the limit is projected to be $1.25 million, creating immediate tax savings and improved cash flow.

Bonus Depreciation: While phasing down (80% for 2023, 60% for 2024, 40% for 2025), this still allows for significant first-year deductions on qualifying property with a recovery period of 20 years or less.

For substantial equipment or real estate component purchases, combining bonus depreciation with cost segregation can generate enormous first-year deductions.

Health-Related Deductions

Health Savings Accounts (HSAs): These offer triple tax advantages—contributions are tax-deductible, growth is tax-free, and qualified withdrawals are also tax-free. For 2025, you can contribute up to $4,300 individually or $8,550 for families, plus a $1,000 catch-up contribution if you're over 55. For entrepreneurs, HSAs can function as stealth retirement accounts. By paying medical expenses out-of-pocket while documenting them, you can later reimburse yourself from the HSA after years of tax-free growth. There's no time limit on reimbursements, creating a powerful tax-free savings vehicle.

Medical Expense Reimbursement Plans: These allow businesses to reimburse employees (including owner-employees in some cases) for medical expenses not covered by insurance on a tax-free basis when properly structured.

Qualified Small Employer Health Reimbursement Arrangements (QSEHRAs): For small businesses not offering group health insurance, these allow tax-free reimbursement of employee healthcare costs up to annual limits ($6,350 individual/$12,800 family projected for 2025).

Tax Credits

Research & Development (R&D) Credit: Available for businesses developing new products, processes, or software, this dollar-for-dollar tax reduction is significantly underutilized by qualifying businesses. Unlike deductions that only reduce taxable income, credits directly reduce tax owed.

Work Opportunity Tax Credit (WOTC): Hiring employees from certain target groups (veterans, SNAP recipients, ex-felons, etc.) can generate credits of up to $9,600 per qualified employee, creating both tax savings and social benefit.

Phase 3: Implementation & Coordination

Unlike most tax advisors who simply make recommendations and leave you to figure out the details, we take a hands-on approach to implementation:

- Coordinate with your existing tax team to ensure seamless execution

- Create detailed implementation timelines and action plans for each strategy

- Model different scenarios to quantify potential ROI before implementation

- Manage documentation and compliance requirements to protect against audit risk

- Oversee implementation across all entities and tax jurisdictions

- Provide ongoing support throughout the implementation process

Phase 4: Ongoing Optimization

Tax strategy isn't a one-time event—it's an ongoing process that requires constant monitoring and adjustment:

- Quarterly strategy reviews to identify new opportunities and adjust existing strategies

- Proactive planning for major events like business acquisitions, sales, or real estate transactions

- Regular coordination with your tax preparation team to ensure alignment

- Continuous identification of new opportunities as tax laws change

- Annual strategy refresh to incorporate changes in your business and personal situation

"Not only did I pay zero federal income taxes last year for all of my companies, I got money back, and he got me $3.5 million in carryforward for the coming year."

Pace Morby

Unpaid client testimonial

Our DEAPR Framework in Action

While every entrepreneur's situation is unique, here are examples of how we systematically implement tax-saving strategies across various levels of complexity:

Foundation Strategies

The Augusta Rule (Section 280A)

- Rent your personal residence to your business up to 14 days annually for legitimate business use

- Create roughly $50,000 of tax-free income

- Leverages legal precedent from Sinopoli vs Commissioner to increase compliance

- Systematic documentation and implementation process.

Strategic Entity Design for 199A Optimization.

- Restructure business entities to maximize the 20% qualified business income deduction

- Strategic wage and profit allocation modeling

- Potential to save thousands (or hundreds of thousands) in taxes annually through proper structuring

Advanced Exit Architectures

Dynasty Trust & Section 1202 Integration

- Rent your personal residence to your business up to 14 days annually for legitimate business use

- Create roughly $50,000 of tax-free income

- Leverages legal precedent from Sinopoli vs Commissioner to increase compliance

- Systematic documentation and implementation process

Strategic Entity Design for 199A Optimization.

- Strategic use of dynasty trusts to maximize Section 1202 qualified small business stock exemptions

- Potential for tens of millions in tax-free proceeds from right fit business sales

- Multi-generational tax benefits

"Dew was instrumental in guiding myself and my partners with tax and asset protection through this process. Working with Jim and his team for two decades has been one of the smartest decisions I have made for myself and my family."

Brad Baumgardner, who recently sold his business to Blackstone for $1.6B

Unpaid client testimonial

Each strategy is implemented

through our systematic process:

Historical Analysis & Opportunity Identification

Strategy

Modeling & ROI Quantification

Coordinated Implementation with Your Tax Team

Ongoing

Monitoring & Optimization

As Robert Kiyosaki stated in "Rich Dad Poor Dad",

"It's not how much money you make, but how much money you keep, how hard it works for you, and how many generations you keep it for."

This principle is at the heart of our approach to tax planning for entrepreneurs.

What Makes Our Approach Different

Traditional tax advisors focus on compliance and reporting. We focus on strategic planning and implementation.

Here's why our approach is different:

Family Office Expertise

We bring billionaire-level tax planning strategies to entrepreneurs who haven't reached billionaire-level wealth yet. Our team has studied how the ultra-wealthy minimize their tax burden and adapted those strategies for seven and eight-figure entrepreneurs.

Fiduciary Alignment

Unlike many tax strategists who earn commissions or success fees (creating potential conflicts of interest), we operate on a transparent fixed-fee model. This ensures we're incentivized to provide strategies that work for the long-term, not just quick wins that might put you at risk.

Comprehensive Implementation

Many tax advisors simply tell you what to do. We actually help you do it by coordinating with your existing professionals, managing timelines, and ensuring proper documentation.

Systematic Process

Rather than ad-hoc advice, we apply a proven four-phase process that ensures no opportunities are missed and all strategies are properly implemented and monitored.

.avif)

"They were able to put in tax strategies to save me hundreds of thousands of dollars. I highly recommend Jim Dew and Dew Wealth and the virtual family office. Take it from a high-net-worth individual who's gotten massive value."

Joel Marion, Co-Founder of BioTrust Nutrition

Unpaid client testimonial

Frequently Asked Questions

How is this different from working with my CPA?

Most CPAs are tax historians - they report what happened. We're tax strategists - we help you proactively plan to minimize future taxes while working alongside your existing team.

How quickly can you implement these strategies?

While some strategies can be implemented immediately, our systematic services typically require at least 90 days to fully implement. We focus on building sustainable, compliant tax strategies rather than quick fixes.

Is this approach audit-safe?

We use well-established planning techniques that have withstood IRS scrutiny. Our systematic approach includes proper documentation and compliance oversight. We're not looking for loopholes; we're looking for legal opportunities within the tax code that most advisors miss.

Do I need to switch CPAs?

No. We can work alongside your existing team, coordinating strategies and ensuring everyone is aligned with your tax reduction goals. If you need an upgrade, you will have access to our 500+ vetted professionals in our rolodex.

How do you charge for your services?

Unlike many "tax strategists" who charge success fees or commissions (which can incentivize overly aggressive strategies that put clients at risk), we operate as a fee-only fiduciary. We charge fixed monthly fees for our services, with no success fees, commissions, or hidden charges. This aligns our interests with yours - we succeed by implementing sound, sustainable tax strategies, not by pushing aggressive approaches that could put you at risk. Our month-to-month relationship structure means we earn your business through results, not long-term contracts.

How do I know if I qualify?

Our approach is most effective for entrepreneurs generating $1M+ in annual revenue who want a systematic approach to reducing their tax burden. If you're at this level, the next step is to schedule a strategy call to explore your specific situation.

Taking the Next Step

If you're an entrepreneur generating $1M+ in annual revenue and want to explore how our systematic approach to tax planning could benefit your situation, let's talk. Schedule a strategy call with us to review your tax opportunities.

During this call, we'll:

Review Your Current Tax Situation

Identify Potential Opportunities

Explain Our Systematic Approach

Determine if We're a Good Fit

While every situation is unique, our data from hundreds of entrepreneurs shows tax savings ranging from $0 to $904,313, with an average savings of $203,769. The key is having a systematic process and the right team to implement it.

Disclosure

Dew Wealth Management, LLC ("Dew Wealth") is an SEC-registered investment adviser located in Scottsdale, Arizona. Registration does not imply a certain level of skill or training. The information provided in this material is for general informational and educational purposes only and should not be construed as personalized investment, tax, or legal advice. All investing involves risk, including the potential loss of principal. The testimonials presented are from actual Dew Wealth clients and reflect their genuine experiences. These clients did not receive compensation for their testimonials. These testimonials may not be representative of all clients' experiences, and there is no guarantee that any client will achieve the same or similar results. The experiences shared reflect the clients' own circumstances and may not be indicative of future results. Testimonials are not indicative of future performance or success.

The tax savings figures mentioned ($0-$904,313 with an average of $203,769) represent historical results achieved for certain clients. These results are based on data collected through 2024 and reflect the experience of specific clients under particular circumstances. Individual results can and will vary significantly based on numerous factors including income level, business structure, tax situation, and implementation of strategies. These figures should not be interpreted as a guarantee or prediction of your potential tax savings. Your actual results may be higher or lower than the examples provided. The tax strategies discussed are general in nature and not tailored to any specific individual's situation. Dew Wealth does not provide tax preparation or legal services. We recommend consulting with qualified tax and legal professionals before implementing any tax strategy. The information provided does not constitute tax advice. Tax laws are subject to change, and strategies that were effective in the past may not be effective in the future. Dew Wealth makes no representations regarding the legal or tax implications of any strategy for your specific situation.

Information on this webpage does not establish an investment advisory relationship, nor does it serve as investment advice or a recommendation to buy or sell any investment product or service. Any reference to investment returns or other performance metrics is provided solely for illustrative purposes and should not be interpreted as a promise or guarantee of future results. Fractional Family Office® is a registered trademark of Dew Wealth Management, LLC. Wealth Waste Calculator® is a registered trademark of Dew Wealth Management, LLC. By accessing, using, or receiving this Document, the Recipient acknowledges and agrees to be bound by the terms and conditions outlined at DewWealth.com/IP.