The Entrepreneur's

Guide to Wealth Transfer

Protecting Your Legacy and Values Beyond Basic Estate Planning

As a successful entrepreneur, you've spent years—perhaps decades—building your business and wealth from the ground up. You've overcome obstacles, seized opportunities, and created something significant in the world. But have you considered what happens to everything you've built when you're no longer at the helm?

The uncomfortable truth is that most entrepreneurs haven't properly addressed their wealth transfer planning. While you've mastered business strategy, scaling operations, and capital allocation, the ultimate exit strategy—what happens to your wealth and business when you're gone—often remains neglected.

This isn't just about documents and taxes. It's about ensuring your life's work continues to make an impact according to your vision, values, and intentions. It's about protecting your family from unnecessary conflict and maintaining the entrepreneurial spirit that created your wealth in the first place.

Whether you're just crossing into seven-figure territory or managing a nine-figure enterprise, the time to think about wealth transfer is now—before circumstances force decisions out of your control.

Schedule a Confidential Wealth Transfer Strategy Session

Cornelius Vanderbilt

The Harsh Reality of Unprepared Wealth Transfer

The 70% Failure Rate

Here's a statistic that should concern every successful entrepreneur: approximately 70% of wealth transfers fail. According to research from Williams Group, seven out of ten wealthy families lose their fortune by the second generation, and 90% lose it by the third.

This isn't primarily due to poor investment decisions or economic downturns. The wealth dissipates because of:

- Lack of communication and trust within the family

- Heirs who are unprepared to manage sudden wealth

- Absence of a clear mission beyond the wealth creator's lifetime

- Insufficient planning for business succession or asset management

These "soft" factors—not estate taxes or poor financial planning—are what most often destroy generational wealth. Consider the Vanderbilt family. Cornelius Vanderbilt amassed a fortune worth approximately $100 billion in today's dollars. Yet, when 120 of his heirs gathered for a family reunion in 1973, not a single millionaire remained among them. The fortune had evaporated in just two generations.

Warren Buffett

The Cost of Doing Nothing

Avoiding wealth transfer planning doesn't mean avoiding the consequences—it means surrendering control over them. Without proper planning, you face:

- Probate court deciding how to distribute your assets

- Potential business disruption or forced liquidation

- Family conflict over business control and inheritance

- Up to 40% of your wealth being consumed by estate taxes

- Your values and vision disappearing with you

As Warren Buffett aptly puts it: "I want to give my kids just enough so that they would feel that they could do anything, but not so much that they would feel like doing nothing."

Essential Legal Foundations

Before addressing the deeper aspects of wealth transfer, establish the fundamental legal framework that protects your assets and ensures your basic wishes are followed.

Last Will & Testament

A will is the starting point for any estate plan, specifying:

- Who receives your assets

- Who will care for minor children

- Who will execute your estate

Entrepreneur Alert: A basic will alone is insufficient for most 7-9 figure entrepreneurs. It becomes public record during probate, provides minimal protection against taxes, and offers limited control over how assets are used after your death.

Power of Attorney

This document designates who will make decisions if you become incapacitated—a possibility that entrepreneurs often overlook despite its devastating potential impact on their business.

Financial Power of Attorney

Ensures business operations continue uninterrupted if you're temporarily unable to manage them

Healthcare Power of Attorney

Designates a trusted person to make medical decisions on your behalf if you become unable to do so

Without these documents, your family may need to petition the court for guardianship—a lengthy,

expensive, and public process that can paralyze business operations at critical moments.

Healthcare Directives

A living will or advance directive specifies your medical treatment preferences if you become unable to communicate them, sparing your family from making agonizing decisions without guidance. For entrepreneurs, clear healthcare directives can prevent business interruption and family conflict during medical emergencies.

Revocable Living Trusts

For entrepreneurs with complex business interests, a revocable trust can be instrumental in maintaining business continuity during incapacity or after death. A revocable living trust offers significant advantages over a will alone:

Avoiding

Probate

Keeping your Affairs Private & Reducing Delays

Providing for

Incapacity

Ensuring Seamless Management of your Assets

Offering More

Control

Over How and When Beneficiaries Receive Assets

Creating

Flexibility

For Changes as Your Circumstances Evolve

The Missing Piece

Not Just Valuables, Transferring Values

Legal documents govern asset distribution, but they don't transmit what truly matters—the values, wisdom, and vision that built your wealth in the first place. As David Rockefeller observes, “I am convinced that material things do not bring happiness... it is the values and traditions which we collectively hold that are most important in determining America's future."

Without understanding the "why" behind the wealth, heirs often squander it, lacking the connection to its purpose and creation.

Creating a Family

Mission Statement

A family mission statement articulates:

- Core values that guided your wealth creation

- Vision for the future of your family and business

- Principles for decision-making across generations

- Expectations for wealth stewardship

This document serves as an ethical constitution for future generations, providing clarity and continuity of purpose long after you're gone.

The Rockefeller family exemplifies this approach. John D. Rockefeller established clear family values centered on philanthropy, stewardship, and education. Six generations later, the family still holds regular meetings to discuss these values and how to apply them in contemporary contexts. Their wealth has endured not just because of sophisticated financial structures, but because of a shared mission that transcends the founder.

Documenting Your Journey & Philosophy

Your entrepreneurial journey contains invaluable wisdom that can guide future generations. Consider creating:

Ethical Will

An ethical will sharing your life lessons and values

Philosophy Document

A business philosophy document outlining your approach to entrepreneurship

Recorded Interviews

Recorded interviews about key decisions and inflection points

Legacy Letters

Letters to future generations explaining your wishes for the family legacy

These "softer" elements of wealth transfer are often overlooked yet prove crucial for long-term wealth preservation.

They connect your heirs to the person behind the assets and the principles that created them.

As the wise Charlie Munger once said,"I think that large amounts of money quite frequently ruin descendants of both sexes. I wouldn't go so far as to say that all children of rich people are ruined. I've seen some children of wealthy people that have done very well."

It’s up to you to ensure that your children end up doing very well with their inheritance.

The Estate Tax Threat

What Entrepreneurs Need to Know

For successful entrepreneurs, estate taxes represent a significant threat to wealth preservation.

Understanding and mitigating this burden is essential for maintaining your legacy.

Current Exemptions & Rates

As of 2025, the federal estate tax exemption stands at $13.99M per individual ($27.98M for married couples). Assets exceeding this threshold face a staggering 40% tax rate.

For entrepreneurs with high-value businesses, this can mean:

- Forced business liquidation to pay the tax bill

- Family conflict over asset distribution

- Significant wealth erosion within a single generation

Business Valuation Implications

For most entrepreneurs, their business represents their largest asset. How this business is valued for estate tax purposes can dramatically impact the tax burden.

- Lack of marketability discounts may reduce valuation

- Minority interest discounts can apply when ownership is divided

- Buy-sell agreements can establish valuation for estate tax purposes

- Family limited partnerships may provide valuation discounts

Without proper planning, the IRS might value your business higher than expected, creating an estate tax bill your heirs cannot pay without selling the business itself.

Sam Walton

Billionaire Strategies for Dynastic Wealth

The ultra-wealthy don't just accept estate taxation as inevitable—they implement sophisticated strategies to minimize or eliminate it entirely. These same approaches, when properly executed, are available to seven and eight-figure entrepreneurs as well.

GRAT: The Walton Family Approach

The Grantor Retained Annuity Trust (GRAT) gained fame through the Walton family's use of it to transfer billions in Walmart stock to heirs tax-free.

Here's how it works:

- Assets are placed in a trust for a specific term (typically 2-10 years)

- The grantor receives annuity payments during the term

- At the end of the term, remaining assets pass to beneficiaries

- The gift tax is calculated only on the projected remainder value at inception

The magic happens when assets appreciate faster than the IRS-assumed rate of return. This excess appreciation passes to heirs completely free of gift and estate taxes. For entrepreneurs with high-growth businesses or investments, GRATs offer an ideal way to transfer future appreciation without tax consequences.

Mark Zuckerberg

Mark Zuckerberg

IDGTs: The Silent Wealth Transfer Vehicle

The Intentionally Defective Grantor Trust (IDGT) is another powerful tool for transferring business interests or appreciating assets to the next generation:

- The trust is "defective" for income tax purposes but effective for estate tax purposes

- The grantor pays income taxes on trust earnings, effectively gifting beneficiaries tax-free

- Assets sold to the trust can be transferred with minimal gift tax impact

- Future appreciation occurs outside the grantor's estate

For entrepreneurs selling their business or transferring ownership interests, IDGTs provide an elegant solution for shifting value to heirs while maintaining income tax simplicity. Mark Zuckerberg reportedly used this strategy to transfer Facebook shares before the company's IPO, saving potentially billions in future estate taxes.

Dynasty Trusts: Multi-Generational Protection

Dynasty trusts represent the pinnacle of generational wealth planning, designed to last for multiple generations—potentially forever in some states:

- Assets placed in the trust remain outside the estate tax system for the trust's duration

- Each generation can benefit from the assets without owning them directly

- The trust provides protection against creditors, divorce, and poor financial decisions

- Wealth can compound for generations without estate tax erosion

States like Nevada, South Dakota, and Delaware have enacted laws specifically favorable to dynasty trusts, eliminating the "rule against perpetuities" that traditionally limited trust duration. The Rockefeller family pioneered this approach, creating trusts that have now benefited six generations while maintaining family control over assets.

.avif)

Strategic Philanthropy:

Leaving a Greater Legacy

For many entrepreneurs, building wealth isn't just about financial success—it's about making a meaningful impact on the world. Strategic philanthropy allows you to extend your values and vision beyond your lifetime while potentially providing significant tax benefits.

Donor-Advised Funds (DAFs)

DAFs offer an immediate tax deduction while allowing you to recommend grants over time:

- Immediate tax deduction for the full contribution

- No capital gains tax on appreciated assets donated

- Tax-free growth of the donated assets

- Simplified administration compared to private foundations

- Lower minimum contributions (typically $5,000-$25,000).

Many entrepreneurs use DAFs as a stepping stone to more sophisticated charitable vehicles, establishing a family tradition of giving while minimizing tax burdens.

Charitable Remainder Trusts (CRTs)

CRTs provide income to you or your beneficiaries for a term of years or lifetime, with the remainder going to charity:

- Immediate partial tax deduction based on the projected charitable remainder

- No capital gains tax when appreciated assets are sold within the trust

- Income stream for you or your beneficiaries

- Estate tax reduction for assets ultimately passing to charity

For entrepreneurs with highly appreciated assets (like business interests before a sale), CRTs can provide significant income while reducing tax burdens and supporting causes you care about.

Private Foundations

Private foundations offer maximum control over charitable giving and can become a vehicle for family values across generations:

- Complete control over grant-making decisions

- Ability to hire family members (with reasonable compensation)

- Public recognition of your philanthropic legacy

- Potential to continue for generations

- Minimum annual distribution requirement of 5% of assets

MacKenzie Scott, Jeff Bezos, Bill Gates, and Warren Buffett have all established major foundations to channel their wealth toward solving societal problems while creating a lasting legacy beyond their business achievements.

How does billionaire Ray Dalio think about incorporating charity into his estate plan? In 2019 he mentioned, "I realized that I didn't want to deprive them of the benefit of having to struggle, so I directed it to philanthropy and they know that. I gave them just enough to be able to do what they want to do.”

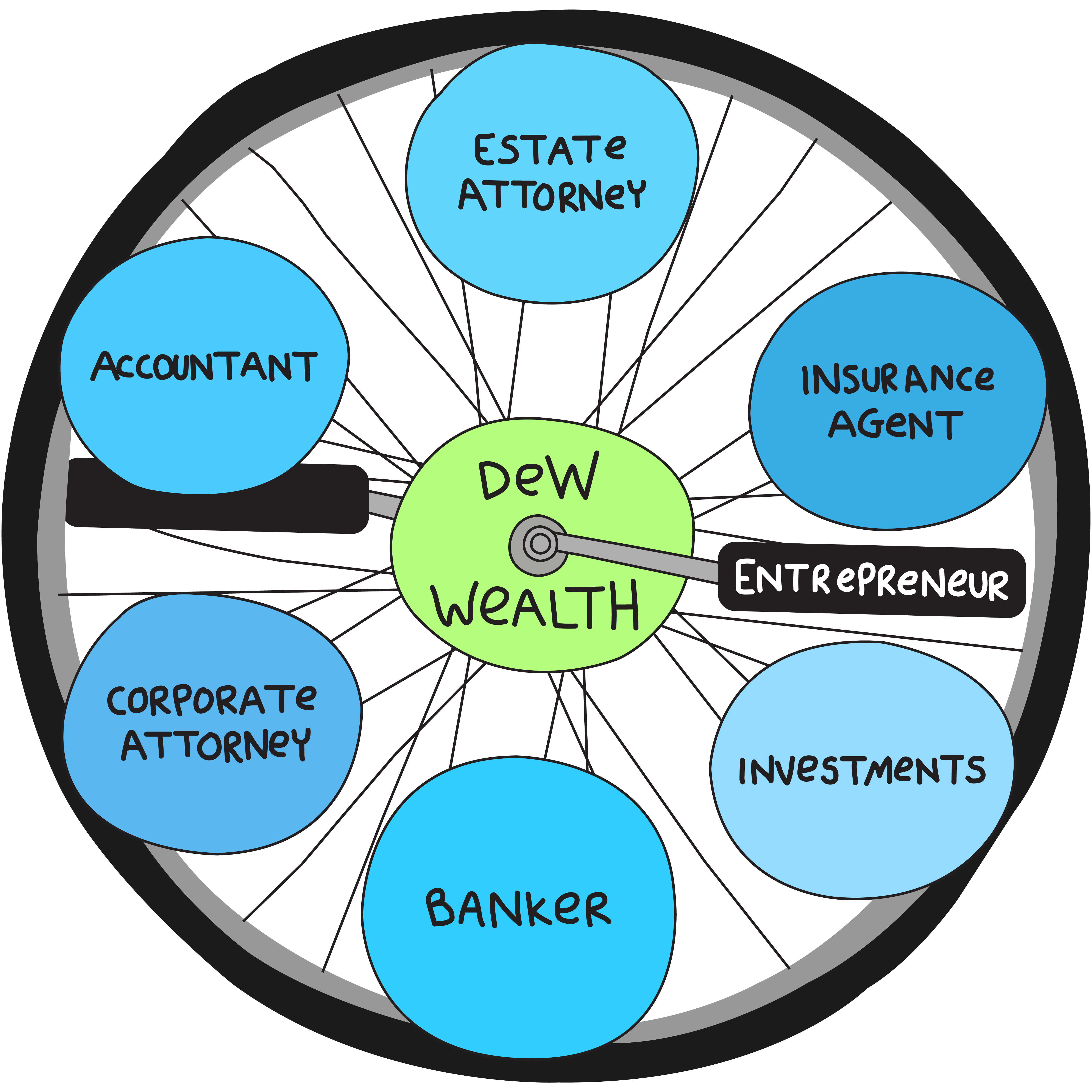

Building Your Wealth Transfer Team

Effective wealth transfer requires specialized expertise across multiple disciplines. For seven to nine-figure entrepreneurs, assembling the right advisory team is essential.

Your wealth transfer team should include:

- Estate Planning Attorney: Specializing in complex business successions and high-net-worth planning

- Wealth Manager: Experienced in entrepreneurial wealth and alternative investments

- CPA: Focused on tax strategies for business owners and wealth transfer

- Business Valuation Expert: For accurate assessment of your most valuable asset

- Insurance Professional: To address liquidity needs for taxes and business continuity

- Trust Officer: For long-term trust administration and implementation

The key is finding advisors who understand the entrepreneur's mindset and the unique challenges of transferring both business interests and personal wealth. More importantly, these professionals must work collaboratively rather than in silos.

"Working with a coordinated wealth management team for two decades has been one of the smartest decisions I have made for myself and my family. They were instrumental in guiding myself and my partners with tax and asset protection through the process."

Brad Baumgardner, who recently sold his business to Blackstone for $1.6B

Unpaid client testimonial

Frequently Asked Questions

When should I start thinking about wealth transfer planning?

The best time to begin wealth transfer planning is now, regardless of your age or wealth level. For entrepreneurs especially, business value can grow rapidly, quickly pushing you into estate tax territory. Early planning provides more options and allows strategies time to work effectively. As your business and wealth grow more complex, retrofitting a plan becomes increasingly difficult.

How much will estate taxes impact my wealth?

Currently, federal estate taxes apply to estates exceeding $13.99 million per individual ($27.98 million for married couples) at a rate of 40%. For entrepreneurs whose businesses represent their primary asset, this can create a significant liquidity problem, potentially forcing a business sale. Additionally, some states impose their own estate or inheritance taxes at much lower thresholds. Proper planning can substantially reduce or eliminate this tax burden.

Can I just give my business to my children to avoid estate taxes?

Simply giving your business away raises several issues. First, lifetime gifts above the annual exclusion amount ($19,000 in 2025) consume your lifetime estate tax exemption. Second, a direct gift provides no protection against your children's creditors, divorce, or poor management decisions. Strategic approaches using trusts, sales, and other techniques can transfer business interests more tax-efficiently while maintaining appropriate controls and protections.

How do I ensure my children don't lose motivation after inheriting wealth?

This common concern can be addressed through thoughtful trust provisions that align with your values. Incentive provisions can encourage education, entrepreneurship, or charitable work. Staged distributions tied to age, milestones, or matching earned income can prevent wealth from undermining ambition. Most importantly, involving your children in your entrepreneurial journey and deliberately teaching them about wealth stewardship prepares them for responsible inheritance.

Do I need to choose between leaving wealth to my family and supporting charitable causes?

Absolutely not. Strategic philanthropy can be integrated with family wealth transfer to achieve both goals. Vehicles like Charitable Lead Trusts can provide current support to charities while ultimately transferring assets to family with reduced gift/estate taxes. Family foundations can involve multiple generations in philanthropic decisions, teaching valuable lessons about wealth stewardship while making a positive impact on causes you care about.

Designing Your Legacy

As an entrepreneur, you've built your success through vision, strategic planning, and relentless execution. Your wealth transfer deserves the same deliberate approach. This isn't just about documents and tax strategies—it's about ensuring the values, principles, and vision that guided your success continue to influence future generations. It's about maintaining the entrepreneurial spirit while protecting the wealth it created.

Without intentional planning, the statistics are sobering: 70% of wealth transfers fail by the second generation. With proper planning—combining technical expertise with clear communication of values—you can be among the successful 30%.

The choice is yours: Will your life's work become a cautionary tale of wealth squandered, or will it become a powerful legacy that benefits generations to come and makes a lasting impact on the world? The time to act is now—before circumstances force decisions out of your control.

Schedule Your Confidential Wealth Transfer Strategy Session

Disclosure

Dew Wealth Management, LLC ("Dew Wealth") is an SEC-registered investment adviser located in Scottsdale, Arizona. Registration does not imply a certain level of skill or training. The information provided in this material is for general informational and educational purposes only and should not be construed as personalized investment, tax, or legal advice. All investing involves risk, including the potential loss of principal. The client testimonial featured in this material is from a current client who did not receive compensation for their statement. This testimonial may not be representative of other clients' experiences, and there is no guarantee that any client will have a similar experience or see similar results. Testimonials are not indicative of future performance or success.

This material contains general discussions of tax and estate planning strategies that may not be applicable to all individuals and should not be considered tax or legal advice. The information provided is based on current tax laws, which are subject to change at any time. Dew Wealth is not a law firm, accounting firm, or insurance agency. We recommend that you consult with qualified tax, legal, and insurance professionals before implementing any strategies discussed herein. Any discussion of specific securities is provided for illustrative purposes only and should not be considered a recommendation to buy or sell any securities. Past performance is not indicative of future results. Future tax laws and regulations may differ significantly from current interpretations. Certain tax or estate planning strategies described may have specific eligibility requirements and potential outcomes can vary significantly based on individual circumstances. Specific tax or legal outcomes cannot be guaranteed. Individuals referenced in hypothetical examples or well-known figures mentioned do not endorse Dew Wealth or its services. Wealth transfer statistics cited are based on research studies and may not reflect current conditions or be applicable to all family situations. The 70% wealth transfer failure rate cited is based on research from Williams Group and may not be predictive of individual outcomes. The value of your investment will fluctuate over time, and you may gain or lose money. Estate tax laws and exemption amounts are subject to change. Current estate tax exemption amounts and rates mentioned are as of 2025 and may be revised by future legislation.

For more information about Dew Wealth and its services, please review our Form ADV Part 2A disclosure brochure and Form CRS, available at www.adviserinfo.sec.gov or upon request. By accessing, using, or receiving this Document, the Recipient acknowledges and agrees to be bound by the terms and conditions outlined at DewWealth.com/IP.